Lender Advertising Program

PrivateLenderLink.com is where real estate investors and mortgage brokers find direct private lending companies throughout the United States. We offer a unique platform for lenders to advertise and generate leads.

A unique and proven lead-generating platform for direct private lending companies

Getting listed on PrivateLenderLink.com puts your company in front of your target audience that are actively seeking private financing for real estate deals. Our platform is an advertising model. Lenders pay a monthly fee, not a fee per lead.

Results-Driven Approach

PrivateLenderLink.com was founded in 2010. Since then, we have been collecting and monitoring data related to lead generation so we can continually improve our site, the experience for our users, and positive results for our lenders.

- Averaging approximately 13,000* visitors per month

- Most traffic from organic (non-paid) Google Searches

- User Types: 80% Borrowers, 20% Brokers

- Asset Class Searches: 75% Residential, 25% Commercial

- Limited number of lenders appear in searches

- Website launched in 2010, has high domain authority

* We will gladly share our recent Google Analytics reports showing a breakdown of the traffic per each state and/or metro area.

We Get 13,000+ Visitors Every Month

- Search Engine Optimization (organic only)

- YouTube Channel with 3,600+ subscribers

- LinkedIn with 5,400+ followers

- Instagram with 2,700+ followers

- Email Newsletters with 10,500+ subscribers

- Advertising with Industry Media Companies

- Our Network of Mortgage Brokers

- Industry Event Sponsorship

- Trade Associations

Lead-Generating Lender Profiles

Build your online profile to showcase your company profile, lending guidelines, loan programs, team headshots, testimonials and much more. Our profiles are very elaborate, but impressive to potential borrowers and brokers.

We have a great system to promote your funded deals. Simply upload a photo and fill out some data fields. We’ll generate a summary and add it to the regional search pages with a link to your profile. We can also promote them in our newsletters and social media.

4 Methods to Receive Leads

Loan Request Invite

Short email form

a few basics about their loan - deal type, property type, amount, LTV, loan term. You can reply to these emails directly; no need to log in.

Phone Call

Website Visits

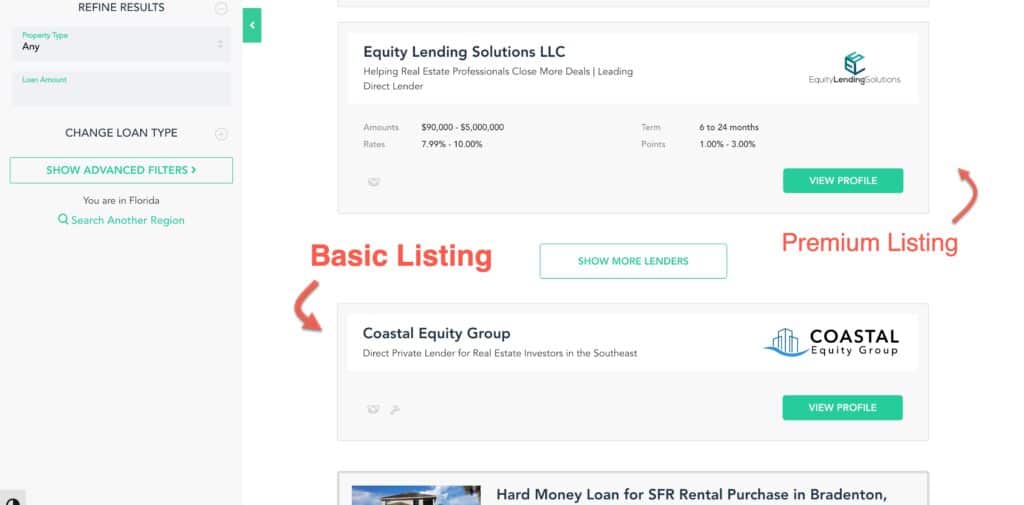

Listing Options

Premium Listings appear on the 1st tier of search results.

When you do a search on our site, all the lenders that you see on the list have a Premium Listing. If you see a SHOW MORE LENDERS button, that exposes the Basic Listings. As of November 2022, only 2 lenders on the platform have a Basic Listing.

The pricing varies based on geography and whether you focus on residential properties versus commercial real estate. Scroll down to view some of our pricing options.

Basic Listings appear on the 2nd tier of search results.

In order to see your listing, site visitors have to scroll past the 1st tier search results and click a SHOW MORE LENDERS button. Therefore, these listing get less exposure, but the pricing is much lower than the Premium listing. The fee ranges from $100 to $450 per month…

- Base Listing Fee: $50 per month

- Per Region Fee: $50 per month

- California $50

- Mid-Atlantic $50

- Midwest $50

- Northeast $50

- Northwest $50

- South $50

- Southeast $50

- Southwest $50

Essentially, the minimum fee is $100/month for your home region, and you can add others if you’d like.

Some lenders choose the Basic Listing only to use our Funded Deals system.

Pricing for Premium Listings

Click the buttons below to see our many pricing options for Premium Listings.

Here are some general terms and features for all of our lender listings…

- No setup fee

- Month-to-month term; no annual contracts

- Cancel at any time with email notice

- Multiple people in your company can manage listing and receive leads

Advertised pricing and terms are subject to change without notice.

Premium Listing in 30+ states, except California, focused on residential investment properties and small multifamily.

$1,750 per month

Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Ground-Up Construction, Residential Long-Term Rental

Premium Listing in 26 states East of the Mississippi River, focused on residential investment properties and small multifamily.

$1,250 per month

Loan Types :

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Ground-Up Construction, Residential Long-Term Rental

Premium Listing in all states West of the Mississippi River, except California, focused on residential investment properties and small multifamily.

$1,250 per month

Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Ground-Up Construction, Residential Long-Term Rental

Premium Listing in all 50 states, focused on residential investment properties and small multifamily.

$2,400 per month

Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Ground-Up Construction, Residential Long-Term Rental

Premium Listing in all states, except California, focused on commercial real estate.

$1,000 per month

Loan Types:

Commercial Bridge, Commercial Value-Add, Commercial Ground-Up Construction, Commercial Loan-Term, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term

Premium Listing in 26 states East of the Mississippi River, focused on commercial real estate.

$500 per month

Loan Types:

Commercial Bridge, Commercial Value-Add, Commercial Ground-Up Construction, Commercial Loan-Term, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term

Premium Listing in all states West of the Mississippi River, except California, focused on commercial real estate.

$500 per month

Loan Types:

Commercial Bridge, Commercial Value-Add, Commercial Ground-Up Construction, Commercial Loan-Term, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term

California pricing is higher because it gets 15-18% of the site’s traffic. We offer a few options:

- All of California: $1,000 per month

- Northern California: $500 per month

- Southern California: $500 per month

- Central Valley & Sacramento: $250 per month

All applicable Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Construction, DSCR Long-Term Rental, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term Commercial Bridge, Commercial Value-Add, Commercial Construction, Commercial Long-Term, Residential Owner-Occupied

Premium Listing in Texas, for residential investment and/or commercial real estate.

$500 per month

All applicable Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Construction, DSCR Long-Term Rental, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term Commercial Bridge, Commercial Value-Add, Commercial Construction, Commercial Long-Term, Residential Owner-Occupied

Premium Listing in Florida, for residential investment and/or commercial real estate.

$500 per month

All applicable Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Construction, DSCR Long-Term Rental, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term Commercial Bridge, Commercial Value-Add, Commercial Construction, Commercial Long-Term, Residential Owner-Occupied

Premium Listing in one large region:

- Midwest

- Northeast

- Northwest

- Southeast

- Southwest

$750 per month

All applicable Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Construction, DSCR Long-Term Rental, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term Commercial Bridge, Commercial Value-Add, Commercial Construction, Commercial Long-Term, Residential Owner-Occupied

Premium Listing in a mid-size region with a few states. Here are some examples:

- DMV (DC, DE, MD, VA)

- Pacific Northwest (ID, MT, OR, WA, WY)

- Southwest (AZ, NM, NV, UT)

- New England (CT, MA, NH, RI, VT)

$500 per month

All applicable Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Construction, DSCR Long-Term Rental, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term Commercial Bridge, Commercial Value-Add, Commercial Construction, Commercial Long-Term, Residential Owner-Occupied

Premium Listing in one small state or metropolitan area. Here are some examples:

- Oregon

- Colorado

- Pittsburgh

- Tampa Bay

$250 per month

All applicable Loan Types:

Private Money, Hard Money, Residential Bridge, Residential Fix & Flip, Residential Rehab & Rent, Residential Construction, DSCR Long-Term Rental, Multifamily Bridge, Multifamily Rehab, Multifamily Construction, Multifamily Long-Term Commercial Bridge, Commercial Value-Add, Commercial Construction, Commercial Long-Term, Residential Owner-Occupied

Does my company qualify to be listed?

- Direct Lenders Only: If the majority of your loans are brokered to other private lending companies or funded with a white-labeled table funding program, you would not qualify. If your loans are syndicated or table funded by investors that do not charge points, we do consider you to be a direct lender. The key factor is whether the borrower has to pay points to two lending entities.

- No Individual Private Investors: We don’t list individual private investors, but there are some exceptions. The key element to determine this qualification is your continuity of available capital. If you do not operate a lending company, we may be able to connect you with loan originators that offer mortgage investment opportunities.

- Focused on Private Lending: We only list lenders that are 100% focused on private lending. If your company primarily offers small business financing and private mortgage lending is one of your many financing options, you would not qualify.

- Established Companies: Your company must have at least 2 years of experience as a direct private mortgage lender, or the founders/owners of the company must have sufficient experience.

- Minimum Company Size is 2: We don’t typically list single-person companies but will consider case-by-case.

Next Steps

Lets Chat

PLL Agreement

Build Your Profile

Ready to move forward?

Sign up and start building your company profile.

Stay Informed About Private Lending