Loan Amounts

Personal Loans Online | Get Up to $35,000 for Any Reason

During uncertain economic times many people can find themselves faced with a situation where they could use some financial assistance. An unsecured personal loan can be a safe and reliable way to meet your financial needs. Use the funds for any purchase or situation…

- Property Down Payment

- Home Improvement

- Medical Emergency

- Consolidating Debt

- Family Vacation

- Wedding

A personal loan is an online installment loan that can be a great option for those customers in the United States looking to borrow money without a lot of hassles. The online process is designed with customer convenience in mind.

REQUIREMENTS

Although we will accept loan requestors with any credit score, there are still a few basic requirements that the lenders in our network are looking for. Before you request a loan, make sure you meet specific criteria regarding these items. Please note that meeting these requirements does not mean that you will be connected to a lender.

Age/ID/Residency Status

You must be 18 or older to be eligible for a personal loan. You must also have a valid Social Security number, and be a legal U.S. citizen or permanent resident. Loan available only in the United States.

Income

In order to ensure that you will be able to repay a loan, you must either have full-time employment, be self-employed, or receive regular disability or Social Security benefits. Some lenders or lending partners may require a pay stub or other form of income verification.

Bank Account

Most loans require a valid checking account, as once a loan is approved for you through PersonalLoans.com, your lender or lending partner will deposit your funds directly into said account.

Credit Type

You do not necessarily need to have a good or excellent credit record to qualify for a personal loan. However, most loans do require that customers demonstrate a pattern of responsibility. To be eligible for a personal loan product, typically an individual must not have any accounts more than 60 days late; must not have active or recent bankruptcies; must not exhibit a pattern of late payments; must not have any debt that cannot be covered by current income; and must not have any recently charged-off accounts.

Meeting these requirements does not necessarily guarantee you will be approved for a personal loan, but it does significantly boost the chances that approval will occur.

HOW IT WORKS

Our simple online loan request process is designed to connect you with a lender or lending partner from our network to fund your loan. In addition to personal loans, some of our lending partners may offer lines of credit. If successfully connected and approved, you can receive your funds in as little as one business day. You will then have anywhere from 90 days to 72 months in which to repay your loan, depending on the terms of the loan agreement. The APR for loans in the personal loan network varies, with many providers offering rates between 5.99% and 35.99%. Please note that our lender network includes tribal lenders. Tribal lenders’ rates and fees may be higher than state-licensed lenders, and are subject to federal and tribal laws, not state laws.

The entire process takes just a few easy steps:

- Loan Request Form

You fill out the simple loan request form on our website, including how much money you would like to borrow, your credit type, and loan reason. The form will also require you to provide some basic personal, banking, and income information. This information will be used by us to determine what loan product you may be eligible for. - Decision

Shortly after receiving your loan request, our affiliate lenders or lending partners will make a decision whether to approve your loan request or not based on the information given. If approved, you’ll be redirected to a loan agreement with clear terms and conditions, including the amount you will need to repay and the repayment time frame. Make sure you understand key elements to your loan agreement, including the loan interest rate as well as the repayment terms before accepting the offer. - Funds Transfer

Shortly after you agree to the terms of the loan agreement the funds will be sent to your bank account. The exact amount of time it takes for your funds to reach your account will depend on the time of loan approval as well as the lender or lending partner you work with, but in all likelihood you will receive the money within one to five business days, depending on your preferences and eligibility. - Account Management

You will then be directed to the Account Center. When you log in, you will be able to change basic information such as your contact information and password. You may also submit another request for a personal loan with the click of a button and using your existing information. We will also present other offers to you in the Account Center, depending on your account preferences. For example, we will soon be offering our customers credit report and credit monitoring services, as well as other products they may qualify for.

APR – Annual Percentage Rate

The annual percentage rate (APR) is the annualized interest rate that you are charged on your loan. PersonalLoans.com is not a lending operation and doesn’t provide loans, but it does refer consumers to professional lenders who can provide quick and convenient loan assistance. We don’t charge fees for this service. PersonalLoans.com does not have the ability to tell you the exact APR that your lender will charge. Annual percentage rates and terms can vary based on not only the information that you supply in your initial loan request, but the information that your lender supplies to you as well.

Your lender will give you the details on the annual percentage rate, cash loan finance charges and other terms once you are redirected to the loan agreement during the process of requesting a personal loan. We recommend that you closely view the terms of any loan offer you get. If you should require help with any PersonalLoans.com–related services, you can contact us at your convenience.

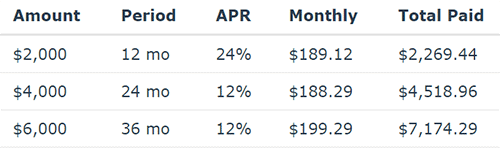

Example of a Personal Loan APR Range

Prior to accepting a particular offer, you may be presented with various loan renewal options by your lender. Carefully look through the loan renewal policy before you electronically sign loan documents of any type. Be aware of the fact that state regulations determine loan renewal policies to a significant extent.

Installment loans or Personal loans should not be used as a long-term financial solution. At PersonalLoans.com, we always encourage borrowers to fully repay their loan by the time it is due so they can avoid fees such as late penalties and nonpayment penalties. If you think that you may experience difficulty paying back a personal loan after borrowing it, PersonalLoans.com advises you to closely examine different loan alternatives before you take the step of requesting for loan assistance through us.

Contact PersonalLoans.com

Stay Informed About Private Lending

Who We Are

PersonalLoans.com provides an easy and convenient way for consumers to be connected with a personal loan through our network of lenders and lending partners. Our online service can enable you to get a loan of between $1,000 and $35,000, right from your home or office, or even on the go through your mobile device. We help people looking to borrow for any number of reasons, whether it be for a home improvement project, a payday loan, debt consolidation, bad credit, medical expense, or anything else. In addition, some lending partners in our network may offer lines of credit.

Though our simple online process is designed to connect our clients to potential lenders or lending partners, we do not function as a lender ourselves. We connect consumers seeking fast, hassle-free financial assistance with skilled, reputable lenders or lending partners who can provide it, and we do this without charging any fees to our customers.

Through PersonalLoans.com, you can get needed loan funds quickly, in as little as just one business day. You don’t have to pay back these funds quickly, however, as the repayment time frame ranges from 90 days to 72 months depending on the terms of your loan. For shorter-terms loans offered, such as installment loans, the repayment time frame may be less than six months.

Legal Disclaimer: PersonalLoans.com connects borrowers with lenders or lending partners and thus the specific terms and conditions of the specific lender or lending partner will apply to any loan a borrower takes out. We are compensated by these lenders or lending partners for connecting you with them, and the compensation received may affect which offer you are presented with. Any display of APR, loan amounts, interest or other loan details are estimations only, and actual amounts will vary by lender or lending partner and by borrower. Please note that some lenders or lending partners may perform credit checks as part of their credit transaction approval process. The lender or lending partner you connect with may not offer the best possible terms and borrowers should always compare all available options before making any decisions. In addition, you may be connected with a tribal lender. Tribal lenders’ rates and fees may be higher than state-licensed lenders, and are subject to federal and tribal laws, not state laws. The owners and operators of PersonalLoans.com are not lenders, they do not broker loans and they do not make loans or credit decisions. Nothing on the website is an offer or a solicitation to lend. Any information you submit to the PersonalLoans.com site will be provided to a lender or lending partner. The operator of the website is not an agent, representative or broker of any lender or lending partner and does not endorse or charge you for any service or product.

Availability: Every state has its own set of rules and regulations that govern personal loan lenders. Your loan amount, APR and repayment term will vary based on your credit worthiness, state and lender or lending partner.

Associations

- Online Lenders Alliance

Office Locations

560 E 200 North, Suite 18, Roosevelt, Utah 84066Contact PersonalLoans.com

Stay Informed About Private Lending

Contact This Lender

Create a Loan Request

Be more efficient with your lender search. Provide the loan details once, save it, and then share it with multiple lenders.

Contact PersonalLoans.com by whichever method you choose.

If you submit a loan request or email, it will be sent to the lender, and they will reply to you directly. A copy will be saved in our database. We will not share your information unless you ask us for recommendations.