Orange County Hard Money Lenders for Real Estate Investors

Need a hard money loan secured by real estate in Orange County? This page has a list of direct hard money lenders that offer quick funding for a Orange County property purchase, refinance, fix & flip, rehab & rent, ground-up construction, and equity cash out in 1st lien position. Hard Money lending is only for investment properties, not for homesteads. The loans are mainly based on equity in the subject property. For most lenders, the maximum LTV is typically 70% for a purchase and 65% for an equity cash out loan.Searching...

Sorry, your search returned no results.

SDC Capital

Family Office Lender. No 3rd-party appraisal (typically). Soft Money Terms in 1st or 2nd Lien Position.

Diversified Mortgage

Multifamily Bridge Loans only. Interest Rates are 8.5% for 4-year term, 8.25% for 2 years, 7.95% for 1 year.

PrideCo Loans Inc.

Family Office Hard Money Lender for Multifamily and Residential Investment Properties

Select a Metro Area

California is a large state, and many hard money lenders focus on particular metropolitan areas. Filter your search by selecting a metro area:

Northern California: SF Bay Area | Sacramento | Lake Tahoe

Southern California: Los Angeles | San Diego | Orange County | Riverside County | San Bernardino County | Santa Barbara

Central California: Central Valley | Bakersfield | Fresno

California Hard Money Interest Rates

According to the hard money loan documents software company, Lightning Docs, the average interest rate for California hard money loans in the 1st quarter of 2024 was 11.23%. The average loan amount was $659,373. These stats are the average of 877 short-term loans (including bridge, rehab, and ground-up construction) funded for properties in California between January 1, 2024 and March 31, 2024 by multiple hard money lenders that use Lightning Docs as their preferred software provider to prepare loan documents.

According to private lending data provider, Analytics Logics, the average interest rate for California hard money loans in the 1st quarter of 2024 was 10.69%. Lenders charged an average of 1.4% points (origination fee). The average LTV (loan-to-value) for hard money loans in California was 64%, and the average loan amount was $808,910. These stats are the average of all the loans which were funded between January 1, 2024 and March 31, 2024 by the many hard money lenders who use Liquid Logics’ loan origination software to manage their lending operations.

Top 10 California Hard Money Lenders

According to Forecasa™, here are the Top 10 Hard Money Lenders ranked by the number of loans originated in California in the last 12 months from March 2024.

- Kiavi

- Anchor Loans

- Val Chris Investment Inc

- Center Street Lending

- Conventus LLC

- Easy Street Capital

- Provident Trust Group

- Merchants Mortgage and Trust Corporation

- Fundloans Capital

- Genesis Capital

Forecasa™ provides analytics data for California hard money lending on a quarterly basis. You’ll find their top lenders data for many other states on our platform.

California Hard Money Lending Guidelines

California has lots of hard money lenders that offer short-term loans secured by real estate. Here are the typical private money lending guidelines for most lenders in California as of March 2024:

- The interest rates for hard money loans in California range from 9% to 12%.

- For a 2nd mortgage in California, most hard money lenders charge 11% to 14%.

- Most California hard money lenders charge an origination fee (aka points) between 2% and 3%.

- The loan amounts range from $100,000 to $20,000,000.

- The maximum loan-to-value (LTV) for hard money 1st mortgages is 70%.

- The maximum combined loan-to-value (CLTV) for hard money 2nd or 3rd mortgages is 65%.

- 2nd mortgages are common in California, and some lenders even consider 3rd or 4th lien position.

- The loan term for most California hard money lenders is 1 year, but some lenders will go up to 5 years.

- Most lenders have a 6-month minimum term (interest guarantee). Some do not have a prepayment penalty.

- The payments for most hard money loans are interest-only, and the entire principal amount is due at the end of the loan term.

- A few hard money lenders in California amortize all of their loans over 20 years.

Hard money lending is mainly for investment properties, but California has some unique laws that enable hard money loans to be secured by a borrower’s primary residence.

Hard Money Loan Transactions in Orange County

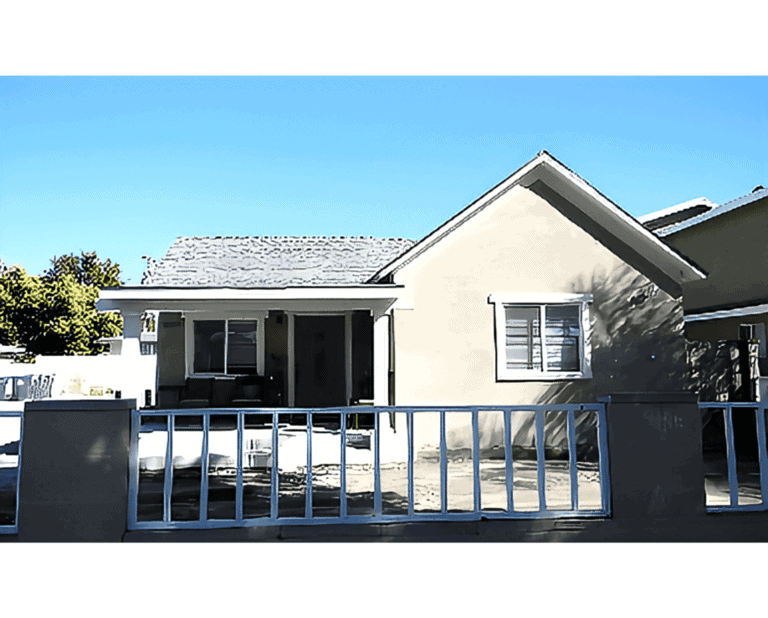

Equity Cash-Out Loan for 3-Unit Rental Property in Santa Ana, California

$595,000

Diversified Mortgage, one of California’s oldest and lowest-priced private lenders, funded a $595,000 1st lien position hard money equity cash-out loan secured by a 3-unit residential rental property in Santa Ana, Orange County, CA. The property value was estimated to be $1,260,000 so our loan-to-value was 47%. The subject property was owned free and clear of any debt at closing. It was fully occupied and cash-flowing. The triplex was in decent condition and didn’t need any major repairs. The cash out was needed for purposes unrelated to the subject property. The Borrower had fair credit. They plan to continue leasing the property and eventually refinance as an exit strategy. The interest rate was 7.95% with amortized payments and we charged 3% origination points. The loan term was set at 48 months. This hard money loan was funded in March 2023.

ARCH Loans, a private lender, funded a $1,750,000 1st lien position hard money loan for the acquisition of a single-family home in Corona Del Mar, California. Corona Del Mar is a coastal city in Orange County. We funded 100% of the purchase price. This project will be a full tear-down and ground-up build. Our Borrower was seeking a hard money loan only for the acquisition, and he will fund the entire construction budget out of pocket. This was a first-time client with ARCH. The Borrower has been working in this market for many years and has a great outlook on the community. The term on this loan is 6 months. The exit strategy will be to complete the ground-up build and list the home for sale immediately upon completion. We were able to conduct an appraisal, underwrite, and fund within one week. This SFR hard money loan was funded in November 2018.