San Diego Bridge Lenders for Residential Investment Property

Are you seeking a bridge loan secured by residential property in the San Diego metro area? On this page you'll find a list of select bridge lenders for San Diego investment properties with 1 to 4 units. To get a 1st lien bridge loan, you must have at least 30% equity. Due to state laws and regulations, it's not possible to get a bridge loan for a homestead (owner-occupied primary residence) or 2nd home, but if that's what you're seeking, use the filters to change the loan type to 'Residential Owner-Occupied' and you may find some alternative lending options.Searching...

Sorry, your search returned no results.

SDC Capital

Family Office Lender. No 3rd-party appraisal (typically). Soft Money Terms in 1st or 2nd Lien Position.

Select a Metro Area

California is an enormous state, and most bridge lenders are selective about where they lend, so filter your search by selecting a metro area:

Northern California: SF Bay Area | Sacramento | Lake Tahoe

Southern California: Los Angeles | San Diego | Orange County | Riverside County | San Bernardino County | Santa Barbara

Central California: Central Valley | Bakersfield | Fresno

California Bridge Loan Interest Rates

According to the loan documents software company, Lightning Docs, the average interest rate for California bridge loans in the 1st quarter of 2024 was 11.23%. The average loan amount was $659,373. These stats are the average of 877 short-term loans (including rehab and ground-up construction loans) funded for properties in California between January 1, 2024 and March 31, 2024 by multiple bridge lenders that use Lightning Docs as their preferred software provider to prepare loan documents.

According to private lending data provider, Analytics Logics, the average interest rate for bridge loans secured by residential investment properties in California in the 1st quarter of 2024 was 10.69%. Lenders charged an average of 1.4% points (origination fee). The average LTV (loan-to-value) for bridge loans in California was 64%, and the average loan amount was $808,910. These stats are the average of all the loans which were funded between January 1, 2024 and March 31, 2024 by the many private lenders who use Liquid Logics’ loan origination software to manage their lending operations.

Top 10 California Bridge Loan Lenders

According to Forecasa™, here are the Top 10 Bridge Lenders ranked by the number of bridge loans originated in California in the last 12 months from March 2024.

- Kiavi

- Anchor Loans

- Val Chris Investment Inc

- Center Street Lending

- Conventus LLC

- Easy Street Capital

- Provident Trust Group

- Merchants Mortgage and Trust Corporation

- Fundloans Capital

- Genesis Capital

Forecasa™ provides analytics data for California bridge loans on a quarterly basis. You’ll find their top lenders data for many other states on our platform.

Residential Bridge Loan Transactions in San Diego

TaliMar Financial, a direct hard money lender based in San Diego, recently funded a $900,000 bridge loan secured by a single-family rental home in Chula Vista, CA. The repeat Borrower approached us with a request to cash out equity on their investment property, which will be used to purchase another rental property. They had purchased the subject property years prior and were holding it as a long-term rental. When a new investment opportunity appeared, they needed to quickly tap the equity in the house to purchase the new property. The loan was structured at 70% of the current value, and we did not require a formal appraisal. The Borrower provided us with financial statements and a copy of the existing lease. We approved the loan and closed in 3 business days. This refinance bridge loan was funded in June 2021.

In March 2021, TaliMar Financial funded an $860,000 1st mortgage bridge loan secured by a condominium in San Diego, CA. The loan was referred to us by a mortgage broker after their original conventional lender was not going to be able to close on time. The Borrower had removed loan contingencies and the seller had multiple backup offers so the Borrower decided to fund a short-term purchase bridge loan. With a quick call between the mortgage broker and Borrower, we structured a loan that met the requirements of the Borrower and closed in less than 5 business days. The mortgage broker, the Borrower, the seller, and both agents were extremely appreciative of our last minute efforts to get the transaction closed. The Borrower put down 25% cash, and our loan funded 75% of the purchase price with an 18-month term. We required no appraisal and requested minimal documentation. The client intends to refinance the bridge loan with conventional bank financing.

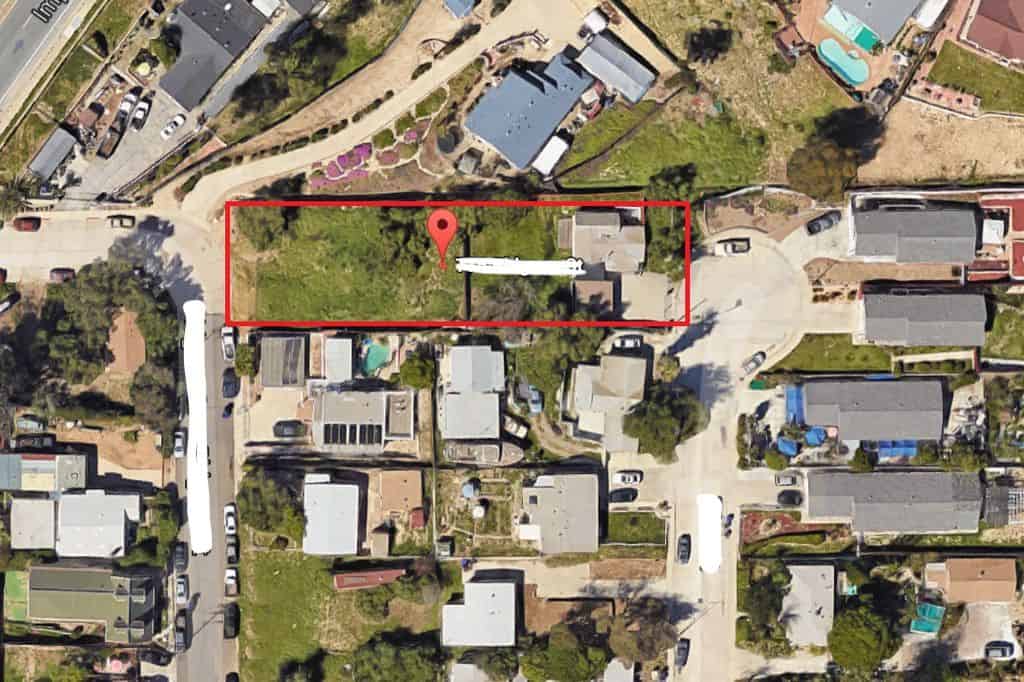

Refinance Bridge Loan for House with ADU in San Diego, California

$701,500

TaliMar Financial funded a $701,500 bridge loan secured in 1st position on a single-family home with an Accessory Dwelling Unit (ADU) in San Diego, California. The purpose of the loan was to pay off a construction loan that was nearing maturity. The Borrower had completed the renovation of the existing house and built the accessory dwelling unit. Both were fully leased at the time of our closing. The Borrower intends to hold the property as a long-term rental property and will obtain conventional financing as the eventual exit to our hard money bridge loan. The biggest hurdle in this transaction was the lack of comparable sales that were in similar condition and included an accessory dwelling unit. Instead of utilizing just comparable sales in our valuation, we considered the income generated from the property for our loan approval. This SFR refinance bridge loan was funded in November 2020.

In October 2020, TaliMar Financial funded a $415,000 1st position Bridge Loan secured on a single-family home with two Accessory Dwelling Units.

The Borrower was seeking a cash-out refinance option from their existing hard money purchase loan. Since originally purchasing the property, the Borrower had reconfigured the existing residence to add a second ADU and built a new 3rd ADU in the rear of the property.

Also known as an ADU, Accessory Dwelling Units are secondary units that can either be added to an existing structure or as a detached unit and be leased as a long-term or short-term rental. ADU’s regulations were designed to help alleviate the housing issues in many urban markets such as San Diego, Los Angeles, and San Francisco. They have become popular with real estate investors that are seeking to boost the cash flow from their investment properties.

Purchase Bridge Loan for Rental Home in La Jolla, San Diego, California

$990,000

Wilshire Quinn Capital, a portfolio bridge lender, funded a $990,000 1st lien position bridge loan secured by a rental home in La Jolla, San Diego, CA. The home was being used as a rental property and the loan allowed the Borrower to pull cash out for business purposes. Located in the Muirlands area of La Jolla, the single-family residence consists of 3 bedrooms, 3 baths, and 2,240 square feet, on a half-acre lot. The property was appraised last month for $1,650,000, giving the Wilshire Quinn Income Fund a total loan-to-value of 60%. This loan was funded in February 2017

In March 2015, Wilshire Quinn Capital funded a private money bridge loan for the purchase of a single family home in Point Loma, San Diego. The Borrower purchased the property from a probate sale and had a tight closing deadline. He used three of his other rental properties as collateral to get the cash needed for the new investment purchase. All were owned free-and-clear of liens and located nearby in Point Loma. The three properties were appraised collectively for $2,565,000 so the total loan-to-value is only 31%. The loan term for this 1st trust deed mortgage is 1 year. The Borrower plans to rehab the property, locate a tenant and then refinance with a conventional loan.

In December 2014, Wilshire Quinn Capital funded a $570K private money bridge loan secured by a single family home in the Point Loma neighborhood of San Diego, CA. The Borrower is a family trust that wanted to cash out equity on their tenant-occupied property. The funds will be used for other investments. The estimated value is $950K so the loan-to-value for this bridge loan is 60% LTV. The Borrower plans to refinance with conventional financing. The loan term was 1 year.