SF Bay Area Private Money Lenders for Real Estate Investors

Seeking a private money loan secured by real estate in the San Francisco Bay Area? On this page you'll find a list of direct private money lending companies that offer fast funding for a Bay Area property purchase, refinance, or equity cash out in 1st lien position. Private money loans are for short term (3-24 months) and primarily qualify based on equity in the subject property, at least 30% for most lenders. So you'll need a 30%+ down payment for a purchase, and for a refinance, the maximum loan-to-value is 70%.Searching...

Sorry, your search returned no results.

Diversified Mortgage

Multifamily Bridge Loans only. Interest Rates are 8.5% for 4-year term, 8.25% for 2 years, 7.95% for 1 year.

Security Financial Services

Direct Lender for Northern California Property Investors | Established 1943

SF Bay Area Private Money Interest Rates

According to the private money loan documents software company, Lightning Docs, the average interest rate for San Francisco Bay Area private money loans in the 4th quarter of 2023 was 10.99%. The average loan amount was $801,625. These stats are the average of 88 short-term loans (including bridge, rehab, and ground-up construction) funded for investment properties in the Bay Area between October 1, 2023 and December 31, 2023 by multiple private lending companies that use Lightning Docs as their preferred software provider to prepare loan documents. Of the 88 total loans in the 3-month period, 26 were secured by properties in Santa Clara County, 25 in Contra Costa County, 17 in Alameda County, 9 in Sonoma County, 6 in San Mateo County, and 5 in San Francico.

Funded Private Money Loans in the Bay Area

Private Money Loan for 2-Unit Residential Property in San Francisco, California

$1,900,000

Private Money Loan for 2-Unit Condo Property in San Francisco, California

$2,000,000

Rubicon Mortgage Fund, a direct private money lender, funded a $2,000,000 1st lien position private money loan for the acquisition of a 2-unit condominium in the top-tier neighborhood of Pacific Heights in San Francisco, CA. We funded 65% of the $3,000,000 purchase price, while the Borrower contributed 35% cash to the purchase at closing. This seasoned entrepreneur was very well qualified and able to put down $1,000,000 cash. During our underwriting, we were able to assess that the purchase was slightly below market. The subject property was newly renovated and tenant-occupied at closing. It is approximately 3,246 square feet, consisting of a house and a small in-law unit. The property had previously been converted from a single family to a condominium. The Borrower had excellent credit. They plan to continue leasing the property and will eventually refinance as an exit strategy. The loan term was set at 12 months, and Rubicon built in an additional option for up to an additional 24 months if needed. This gives the Borrower additional flexibility to keep our loan for up to 3 years. This SFR private money loan was funded in November 2023.

Private Money Loan for Retail Property Purchase in Los Gatos, California

$1,700,000

Rubicon Mortgage Fund, a direct private money lender, funded a $1,700,000 1st lien position private money loan for the acquisition of a retail property in Los Gatos, California. We funded 56% of the $2,350,000 purchase price, while the Borrower contributed 28% cash plus equity in another property. As a private debt fund, Rubicon can creatively structure financing solutions to fit each client’s individual needs. In this case, the Borrower was a tenant who had the option to buy the property. They signed the lease in 2022 and spent around $600,000 on improvements to start an upscale restaurant. They chose to exercise their option when the previous owner decided to put the property on the market for sale. Since the business had been operating for less than 1 year, they were not able to meet the requirements to secure SBA or conventional debt. We creatively structured this deal using both the Los Gatos retail property as well as additional collateral to provide a combined loan-to-value of 56%. The Borrower contributed $650,000 in cash toward the purchase, and they also pledged a condominium unit located in Santa Clara County which was worth around $600,000 and owned free-and-clear of any debt. The retail property was in excellent condition and is approximately 2,870 square feet. The Borrower plans to refinance with a conventional or SBA loan as soon as possible. The loan term was set at 12 months with an extension option. This private money loan was funded in June 2023.

Private Money Loan for Single-Family Residence in Danville, California

$1,505,000

Karpe Real Estate Center, a direct private lender for Central California real estate, funded a $1,505,000 1st lien position private money loan for the acquisition of a single-family home in Danville, an affluent town just east of Oakland, California. We funded 70% of the $2,150,000 purchase price, while the Borrower contributed 30% cash at closing. The Borrower used a combination of cash and 1031 exchange funds from another property sale to buy this single-family home in a gated community. They plan to hold it as a long-term rental. They had good credit. Karpe was able to provide an 18-month bridge loan while the Borrower leases the property to a long-term tenant. They plan to refinance with a conventional or DCSR rental loan. The subject property was in excellent condition and vacant at closing. The interest rate was 11%. This SFR private money loan was funded in June 2023.

Private Money Loan for 6-Unit Multifamily Purchase in Berkeley, CA

$1,500,000

Security Financial Services, a direct private lending firm based in San Francisco, provided a $1,500,000 bridge loan to secure the acquisition of a 6-unit multifamily property in Berkeley, CA. The purchase price was just over $2,300,000 so the loan-to-value for our 1st position private mortgage was 65% and the Borrower contributed 35% cash. The subject property was in good condition and partially occupied at closing. The improvements were constructed in 1920 and are situated on a single parcel. The Borrower intends to remodel units, and upon completion of the 6-month loan term, they will lease the vacant units at the market. The Borrower plans to refinance into permanent financing. This multifamily private money loan was funded in December 2022.

Private Money Refinance for Luxury Home in Tiburon, Marin County, California

$6,100,000

Private Mortgage Fund LLC, a direct California private lender, funded a $6,100,000 1st lien position private money refinance loan secured by a residential investment property in Tiburon, Marin County, CA. The Borrowers had the home on the market for sale, but the note was coming due, and they had less than one week to pay it off. We did an in-house valuation and found the LTV was less than 60%. We got this loan funded in just 3 days, with no appraisal required. Although the home is on the market for sale, we set the loan term at 2 years, and there is no pre-payment penalty. The subject property is over 8,000 square feet, and features 5 bedrooms, a tennis court, infinity pool, a four car garage, guest quarters, and much more. This SFR private mortgage loan was funded in September 2019.

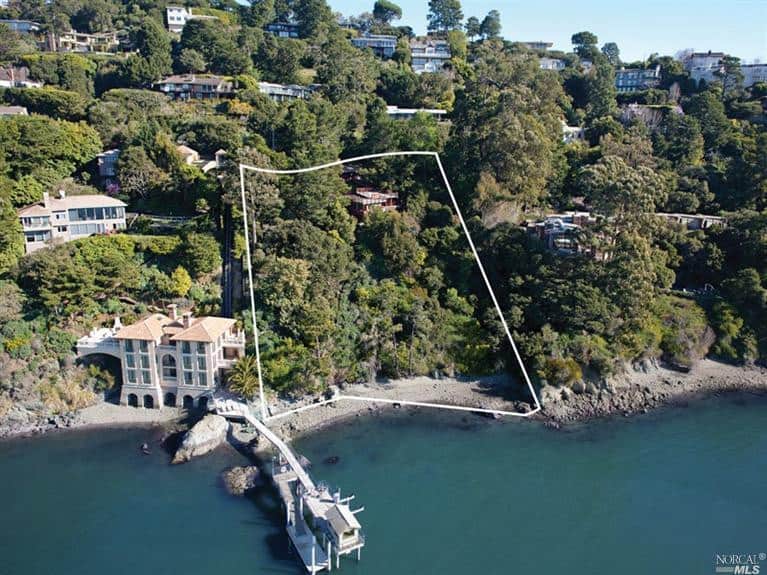

Private Money Loan for Residential Land Refinance in Belvedere, California

$2,000,000

First Bridge Lending, a direct private lender in the North Bay Area, funded a private money loan secured by a waterfront residential lot in Belvedere, CA. The Borrower is an experienced developer who has completed major renovations on 4 Marin County homes in the last 24 months. They purchased this 1.23-acre parcel in a premium neighborhood with views of the Golden Gate Bridge. They had already secured permits and entitlements for a 12,500-square-foot home with a boat dock and waterfront casita. They needed to pay off a matured loan that was in place for a short period of time before obtaining construction financing. We determined the value to be around $5,260,000 so the LTV for our 1st mortgage is just 38%. First Bridge does not typically consider land loans. However, due to the low loan-to-value and Borrower’s track record, we were able to make an exception. We expect to be refinanced within 12 months. This private money loan was funded in August 2019.

Private Money Line of Credit Secured by Residential Property in San Francisco, California

$2,100,000

Stonecrest Financial, a direct California private lending firm, funded a $2,100,000 1st lien position private money line of credit secured by the primary residence of a business owner in San Francisco, CA. This relatively new company has been killing it for a couple of years now but came upon a challenging time due to a big flood in their newly leased second location about a year ago causing them to be financially handcuffed. They took out an emergency business loan that turned out to be over 50% annual interest due to the complicated way it was arranged. We rescued them with a new $2,100,000 loan which paid off the previous lender and provided a flexible credit line, enabling them to reduce their mortgage payments by over $40,000 per month and provide the capital needed to continue with their business expansion plans. The subject property is a single-family residence in Pacific Heights, owned and occupied by one of the business partners. The appraised value was $4,700,000 so the loan-to-value for our 1st mortgage was just 44% LTV. We don’t typically consider an owner-occupied home for our loans, but the exception is when the funds are to be used for a business purpose. This SFR private money loan was funded in September 2019.

Private Money Loan for SFR Investment Purchase in Palo Alto, California

$1,993,000

First Bridge Lending, a direct private lender in the North Bay Area, funded a private money loan for the purchase of a single-family investment property in Palo Alto, CA. The Borrower is an experienced house flipper who was trying to obtain bank funding for this deal, but it was taking too long. The seller was ready to take a back-up offer and keep the significant earnest money deposit. The Borrower turned to First Bridge for help, and we were able to provide loan documents that were ready to sign that same day. We funded the loan in less than 48 hours, saving the deal and the Borrower’s deposit. The sale price was $2,768,000. The Borrower put down 28% of the purchase price in cash, so our 1st mortgage was 72% loan-to-value. This SFR private money loan was funded in April 2019.

The borrower is an active real estate investor who wanted to take advantage of our Line of Credit product for other real estate projects. We provided him with a $820k credit line in 2nd position on his home in Palo Alto at a combined loan-to-value of 59%. This 1-story home has 3 bedrooms and 2 bathrooms. Built in 1959, it is 1,436 sqft and sits on a 7,345 sqft lot. The home has been completely remodeled. The property has refinished wood flooring throughout, granite kitchen counters and crown molding. Stonecrest funded this private money mortgage in January 2018.

Private Money Line of Credit for 2 Commercial Properties in Mountain View, California

$900,000

Stonecrest Financial, a direct private mortgage lender based in San Jose, funded a $900,000 2nd mortgage secured by 2 commercial buildings in Mountain View, California (Silicon Valley). The Borrower, a past Client, owns a successful BMW motorcycle dealership that occupies 2 buildings in the heart of Mountain View. They were in need of some funds for inventory management purposes. We provided a $900K loan as a line of credit in 2nd position behind a $1,200,000 1st mortgage. The property was valued at $5,300,000 so the combined loan-to-value was around 40%. With our revolving credit line structure, the Borrower will only pay interest on the funds used and can pay down the balance at any time within the loan term. The building is approximately 11,200 sq ft and sits on a .71 acre lot. The commercial service zoning allows both retail and industrial uses. This private money loan was funded in December 2017.

2nd Mortgage Private Money Loan for Rental Property in Los Altos, California

$500,000

SDC Capital, a direct private lender based in Burbank, funded a $500,000 2nd mortgage private money loan for a rental property in Los Altos, Santa Clara County, CA. The Owner needed the funds for a business purpose. After speaking with several lenders, the Borrower selected SDC Capital based on our overall pricing structure and quick funding timeline. This private money loan was funded in February 2017.