Florida Fix and Flip Lenders

Are you flipping residential properties in Florida? On this page you'll find a list of fix and flip lenders throughout the Sunshine State. Fix & flip lending is only for residential properties with 1-4 units. We have a separate page for lenders that offer rehab/value-add financing for other property types. The maximum loan-to-after repair value (LTARV) for most lenders in Florida is 70%. You typically need some cash for the purchase (15%-20%) and some cash reserves.Searching...

Sorry, your search returned no results.

Malve Capital LLC

Fast And Easy Real Estate Loans. Closing as fast as 5 business days, subject to clear title.

RBI Private Lending

Direct lender, specialized in Bridge, Fix and Flip and Construction. FN and new investors welcome.

Equity Lending Solutions LLC

Reliable Capital for Fix & Flip and Ground Up Construction Loans / Direct Private Lender

Select a Metro Area

Florida is an enormous state, and most fix & flip lenders are selective about where they lend. Filter your search by selecting a metro area:

Miami & Fort Lauderdale | Orlando | Tampa Bay | Jacksonville | Palm Beach County | Fort Myers | Tallahassee | Pensacola

Funded Fix & Flip Loans in Florida

Easy Street Capital, a direct private real estate lender, funded a $332,500 1st lien position fix and flip loan for a single-family home in Lauderdale Lakes, FL. We funded 90% of the $310,000 purchase price and $60,700 renovation budget, while the Borrower contributed 10% cash at closing. The after-repair value was estimated at $475,000 so our loan-to-after-repair value was 70%. The Borrower plans to complete a full cosmetic rehab on the property and has accounted for demolition, foundation, and servicing of utilities as needed in the budget. The subject property will be a 4-bedroom, 2-bath once completed. The interior rehab includes new paint, flooring, appliances, and an updated kitchen and bathroom. The exterior rehab includes roof replacement and new paint before the home is put on the market for sale. The subject property is approximately 1,703 square feet set in a 9,037-square-foot lot. The Borrower had good credit. The interest rate was 11.9% and we charged 2% origination points. The loan term was set at 9 months. This SFR fix and flip loan was funded in March 2024.

Easy Street Capital, a direct private real estate lender, funded a $335,750 1st lien position fix and flip loan for a single-family home in St. Petersburg, Florida. We funded 85% of the $80,000 renovation budget and $315,000 purchase price, while the Borrower contributed 15% cash respectively at closing. The after-repair value was $490,000 so our loan-to-after-repair value was 69%. The Borrower will be doing a cosmetic rehab of the subject property with some servicing of the utility systems and demolition. It will be a 3/2 combo once completed. The interior of the home will be getting new drywall, paint, flooring, and an updated kitchen/bathroom. The exterior of the home will be getting new roofing and paint. The property is approximately 1,263 square feet set in an 8,952-square-foot lot. The Borrower plans to sell the property as an exit strategy. The interest rate was 10.9% and we charged 2% origination points. The loan term was set at 6 months. This SFR fix and flip loan was funded in September 2023.

RCN Capital, a national direct private lender, funded a $934,500 1st lien position fix and flip loan for a single-family residence in Destin, FL. We funded 100% of the $129,350 renovation budget and 70% of the $983,500 purchase price, while the Borrower contributed 30% cash to the purchase at closing. The subject property was appraised for $1,170,000 As-Is and an after-repair value of $1,335,000 evidenced a 16.86% return on investment for the Borrower. Our loan-to-value was 70%. The Borrower was an experienced investor (3+ Verified) under contract to acquire the subject property for $983,500 (Net Seller Credit $16,500). They are experienced in handling this type of flip and have good liquidity. The subject property is located in a popular neighborhood in the Crystal Beach area and is just 2 blocks from the beach. The subject property is approximately 2,604 square feet set in a 7,501-square-foot lot. The Borrower plans to sell the property upon completion of the rehab. The interest rate was 11.49% and we charged a 1% origination point. The loan term was set at 12 months. This SFR fix and flip loan was funded in February 2023.

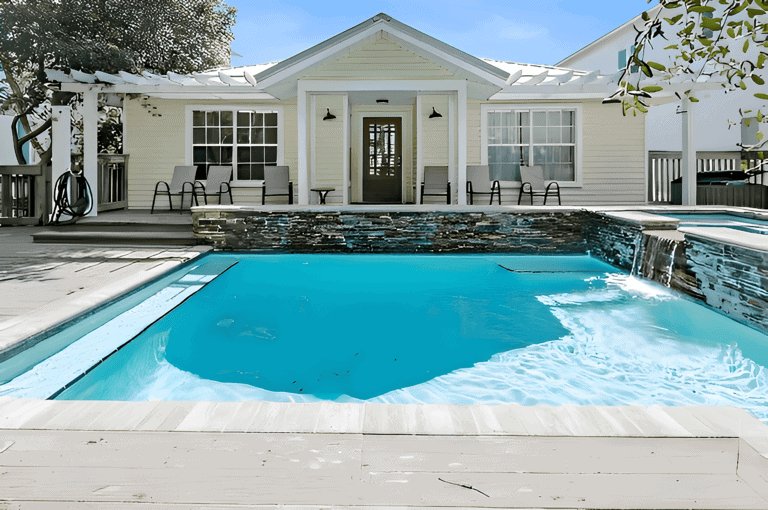

Navigator Private Capital, a nationwide private real estate lender, funded a $1,530,000 fix and flip loan for a single-family residence in Panama City, Florida. Our clients found this neglected fixer-upper and were able to envision all that it could become. Looking past its current condition, they recognized the enormous potential in its size and layout. With a purchase price of $1,200,000 and a repair budget of $450,000, this six-bedroom, seven-bathroom home was renovated from top to bottom. Navigator Private Capital funded 100% of the renovation budget and financed 90% of the purchase price in first lien position, while the Borrower contributed 10% cash. The loan-to-after-repair value was 68% and the after-repair value (ARV) was estimated to be $2,225,000. The Borrower had an excellent credit rating and plans to sell the property after rehab, within the 12-month loan term.

This gorgeous waterfront location in a protected cove with easy access to the Intracoastal Waterway and the Gulf of Mexico boasted over 5,500 square feet of fully modernized space. This beauty had plenty of room for a family (or two) to spread out, with outstanding water views from nearly every room. It’s an entertainer’s dream, but the transformation doesn’t stop on the inside- get ready for backyard entertainment as well with a private pool, a dedicated boat dock, and an outdoor kitchen. This SFR fix and flip loan was funded in March 2022.

PURCHASE PRICE: $470,000

REHAB BUDGET: $88,000

AFTER-REPAIR VALUE (ARV): $720,000

LOAN-TO-COST (LTC): 83%

This i Fund Cities client is a successful fix and flip investor doing beautiful remodels in a cool beach town on the eastern Florida coast. The company was reaching their loan capacity with their current private lender. They needed a new lender option that would allow them to keep their business growing and thriving. The client found i Fund Cities through Instagram. When they called and told us about their goals, and showed us the work that had done, we were able to provide them funding to complete two of their projects.

The KEY LOAN BENEFIT to the borrower was that not only did we help them complete their current projects, we are excited to grow with them by allowing them to originate loans with us up to $25 million. (Now, there’s a sunny growth curve!)

Private Money Fix & Flip Loan for Single-Family Home in Century, Florida

$115,500

RCN Capital, a national direct private lender, funded a $115,500 1st lien position fix and flip loan for a single-family home in Century, Florida. A team of real estate investors were looking for the funds to purchase and renovate this single-family home in Century, a town in Escambia County, Florida. RCN Capital was able to provide 80% of the purchase price and 100% of the renovation costs, while the Borrower contributed 20% cash to the purchase at closing. The loan term was 12 months. The total rehab costs are $60,000. Upon completion, the property will have an appraised after-repair value of $200,000. The investors anticipate a 14% return on investment once complete and the property is sold. This SFR fix and flip loan was funded in December 2018.