Tampa Fix and Flip Lenders

Are you flipping residential properties in the Tampa metro area? On this page you'll find a list of fix and flip lenders throughout Tampa's urban areas. Fix & flip lending is only for residential properties with 1-4 units. We have a separate page for lenders that offer rehab/value-add financing for other property types. The maximum loan-to-after repair value (LTARV) for most lenders in Tampa is 70%. You typically need some cash for the purchase (15%-20%) and some cash reserves.Searching...

Sorry, your search returned no results.

Malve Capital LLC

Fast And Easy Real Estate Loans. Closing as fast as 5 business days, subject to clear title.

Equity Lending Solutions LLC

Reliable Capital for Fix & Flip and Ground Up Construction Loans / Direct Private Lender

RBI Private Lending

Direct lender, specialized in Bridge, Fix and Flip and Construction. FN and new investors welcome.

Select a Metro Area

Florida is an enormous state, and most fix & flip lenders are selective about where they lend. Filter your search by selecting a metro area:

Miami & Fort Lauderdale | Orlando | Tampa Bay | Jacksonville | Palm Beach County | Fort Myers | Tallahassee | Pensacola

Funded Fix & Flip Loans in Tampa Bay

Park Place Finance, a direct private real estate lender, funded a $250,400 1st lien position fix and flip loan for a single-family home in Tampa, FL. We funded 100% of the $55,000 construction budget and 75% of the $258,000 purchase price, while the Borrower contributed 25% cash to the purchase at closing. The after-repair value was estimated at $400,000 so our loan-to-after-repair value was 62%. The Borrower is a first-time flipper, which we do consider. To make up for the lack of experience, newbie investors typically need to have lots of liquidity and a high credit score. The interest rate was 12.99%. The loan terms were our standard 12-month term loan with interest-only payments and no prepayment. This SFR fix and flip loan was funded in February 2024 and we have since helped the Borrower on another property in Tampa.

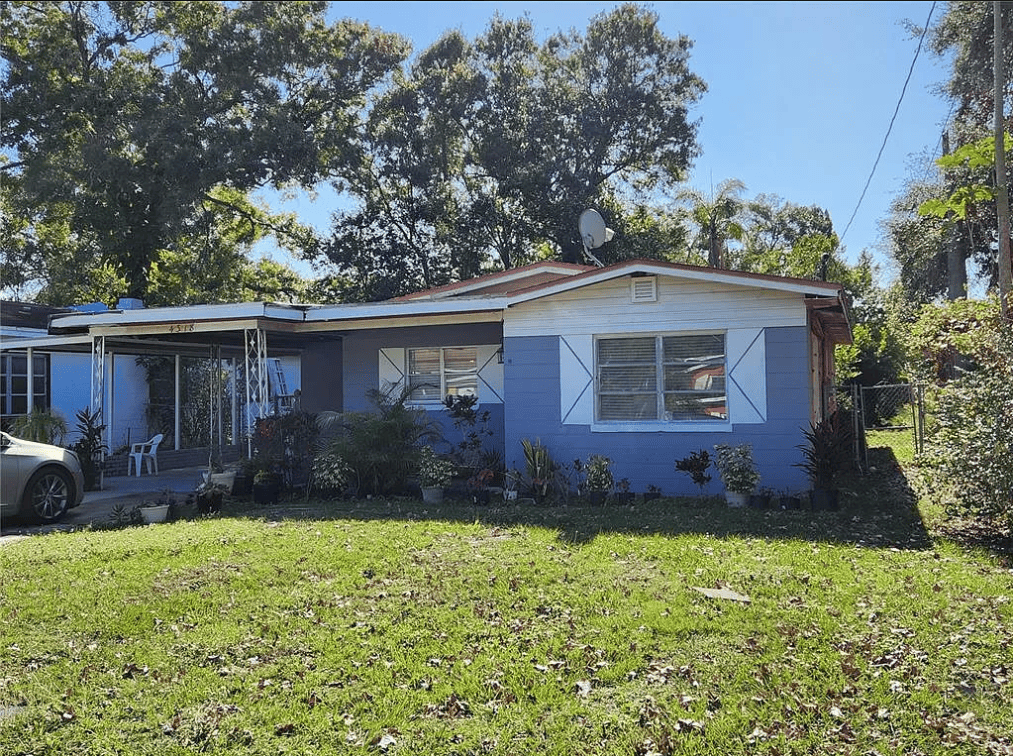

Easy Street Capital, a direct private real estate lender, funded a $352,750 1st lien position fix and flip loan for a single-family home in St. Petersburg, FL. The investor has already purchased the property with financing. We refinanced the previous loan and funded 100% of the $70,000 renovation budget. The after-repair value was $525,000 so our loan-to-after-repair value was 67%. The Borrower will be doing a full remodel of the subject property with some servicing of the utility systems and demolition. The interior of the home will be getting new doors, texture, drywall, insulation, paint, flooring, appliances, and an updated kitchen/bathroom. The exterior of the home will be getting new roofing, paint, doors, and landscaping before the home is listed on the market for sale. The subject property was approximately 1,538 square feet set in a 5,123-square-foot lot. The Borrower had good credit. They plan to sell the property as an exit strategy upon completion of the light rehab. The interest rate was 10.9% and we charged 3% origination points. The loan term was set at 9 months. This SFR fix and flip loan was funded in February 2024.