Georgia Bridge Lenders for Commercial Real Estate

Are you seeking short-term financing secured by commercial real estate in Georgia? On this page you'll find a list of select CRE Bridge Lenders that can finance a Georgia property purchase, 1031 exchange, refinance, or equity cash out in 1st lien position. We have a separate page for lenders that can fund a rehab / value-add project. The maximum loan-to-value for most CRE bridge loans is 70%, and some lenders can go up to 75% for retail and industrial properties. The max LTV is typically much lower for office, hotels, and specialty property types.Searching...

Sorry, your search returned no results.

Funded CRE Bridge Loan Transactions in Georgia

Sherpa Capital Group, a direct private lending firm based in Chicago, funded a $2,500,000 1st lien position bridge loan for the acquisition of a 120-unit hotel in suburban Atlanta, GA. We funded 71% of the $3,500,000 purchase price, while the Borrower contributed 29% cash at closing. The timing from Term Sheet to Close was under 3 weeks. The Sponsor plans to convert the hotel into short-term rentals and workforce housing, which will address the growing demand for affordable housing in the area. We are not funding any renovations for the conversion. The subject property was in good condition. The Borrower had excellent credit. They plan to continue leasing the property and eventually refinance with a conventional loan as an exit strategy. The loan term was set at 12 months. This CRE bridge loan was funded in February 2023.

Equity Cash Out Bridge Loan for Golf Course in Bishop, GA

$840,000

In August 2021, Commercial Capital BIDCO funded a cash-out refinance bridge loan secured by a recently-purchased 18-hole luxury golf course located in Bishop, Georgia. The Borrower needed funds to purchase maintenance equipment for the course as well as working capital for the next year of operation. As of 2020, the tax card valued the property at $2,489,339. Therefore, our $840,000 bridge loan’s loan-to-value is just under 34%. Based on the price that the golf course was recently purchased for, our loan-to-purchase price is approximately 56%. The Borrowers plan to seek permanent financing with a local bank once one year of ownership has been reached. The property consists of 190 acres and is fully operational.

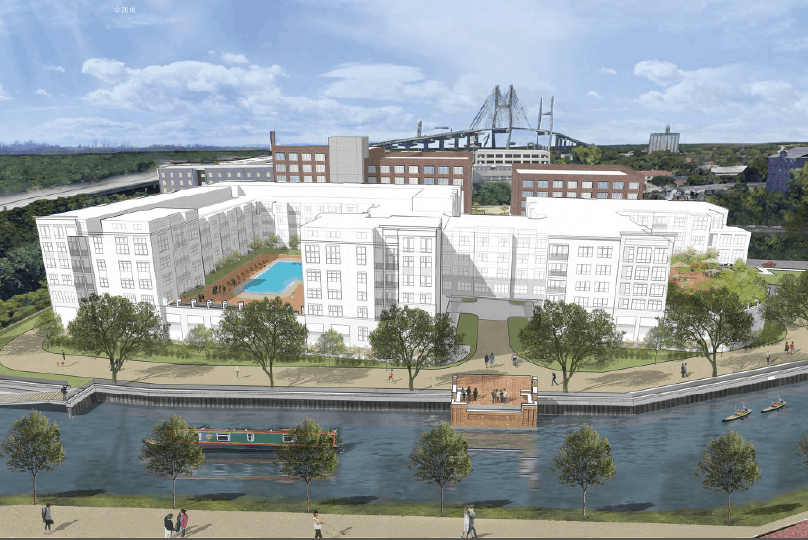

Non-Recourse Bridge Loan for Land Acquisition in Savannah, Georgia

$2,200,000

BridgeInvest, a direct CRE private lender, funded a $2,200,000 1st lien position, first-priority, land acquisition, and pre-development loan secured by a well-located multifamily development site totaling 1.64 acres in Savannah, Georgia. The loan allowed the Borrower to purchase the property and proceed with finalizing the development plan and obtaining construction financing. The proposed project is a 164-unit, 6-story multifamily complex, which is only a 15-minute walk from the heart of downtown Savannah. The project will contribute to the continued improvement and revitalization of historic Savannah. BridgeInvest was able to finance over 65% of the below-market acquisition price due to the site’s development potential. We remained engaged with the deal throughout a significant change in the business plan. The loan was structured based on the underlying collateral value, despite no existing cash flow. This purchase bridge loan was funded in August 2018.