North Carolina Fix and Flip Lenders

Are you flipping residential properties in North Carolina? On this page you'll find a list of fix and flip lenders throughout North Carolina. Fix & flip lending is only for residential properties with 1-4 units. We have a separate page for lenders that offer rehab/value-add financing for other property types. The maximum loan-to-after repair value (LTARV) for most lenders in North Carolina is 70%. You typically need some cash for the purchase (15%-20%) and some cash reserves.Searching...

Sorry, your search returned no results.

Malve Capital LLC

Fast And Easy Real Estate Loans. Closing as fast as 5 business days, subject to clear title.

RBI Private Lending

Direct lender, specialized in Bridge, Fix and Flip and Construction. FN and new investors welcome.

North Carolina Residential Fix & Flip Insights from a Local Lender

The real estate market in North Carolina is similar to many states throughout the country today, especially when it comes to fix and flip properties where profit margins remain low. Mitchell Zargrodnik of RCN Capital states that because of this common challenge, many of their investor clients are starting to diversify into the buy and hold market. Mitchell explains that although the initial plan is to flip the property, sometimes they’ll see investors decide to change over and hold the property long term, and then, make sure that there’s a buyer when these properties get relisted. “Investors just have to be cautious about the amount of rehab that they’re putting into these properties for resale, because if the value is a little too inflated, that kind of checks off a base of buyers there that aren’t willing to pay so high. You’re seeing experienced investors be a little bit more strategic, a little more lighter cosmetic rehab on these deals and, looking to make a nice quick profit on a short-term-time frame as well,” he suggests.

According to RCN Capital, even with these challenges, investors aren’t shying away from heavy rehabs in many parts of North Carolina. Mitchell says that they are still seeing a significant amount of interest in rehab projects that involve adding square footage to existing single family properties. “We have a lot of families that want to move into the Charlotte area, as well as the surrounding cities. Charlotte, Gastonia, Durham, Raleigh, Kerry, are the cities where we’re seeing a lot of this action and families looking to move into those locations want to make sure that the property is big enough to feel comfortable,” Mitchell says.

RCN Capital® is a nationwide, direct private lender. They provide short-term and long-term hard money loans to real estate investors. As a direct private lender, RCN Capital takes a common sense approach to underwriting, with all approvals made in-house, and are dedicated to providing a quick response to time-sensitive loans. RCN’s rehab loan program is pretty straightforward. They can do up to 85% of the purchase price and lend 100% of the renovation costs as well, not to exceed 70% of the after repair value. 85% of the purchase price is going to be based on experience, where the investor has can show that they have experience with doing heavy to moderate rehab projects, and/or have completed at least three rehab projects within the last three years. View their profile to find their contact information and learn more.

Funded Fix & Flip Loans in North Carolina

RCN Capital, a national direct private lender, funded a $598,500 1st lien position fix and flip loan for a single-family home in Charlotte, NC. We funded 100% of the $95,740 renovation budget and 77% of the $565,000 purchase price, while the Borrower contributed 23% cash to the purchase at closing. The after-repair value was $855,000, evidencing solid returns to Borrowers of just under 26.16%. Our loan-to-after-repair value was 70%. This repeat and experienced Borrower plans to add a second story to the home. They plan to sell the property as an exit strategy. The 1,737-square-foot subject property was appraised for $650k As-Is. The Guarantor had excellent credit and bank statements that reflected sufficient liquidity to meet the reserves required for this loan. The Initial advance was 88.987% loan-to-cost. The interest rate was 10.99% and we charged 0.5% origination points. The loan term was set at 12 months. This SFR fix and flip loan was funded in November 2023.

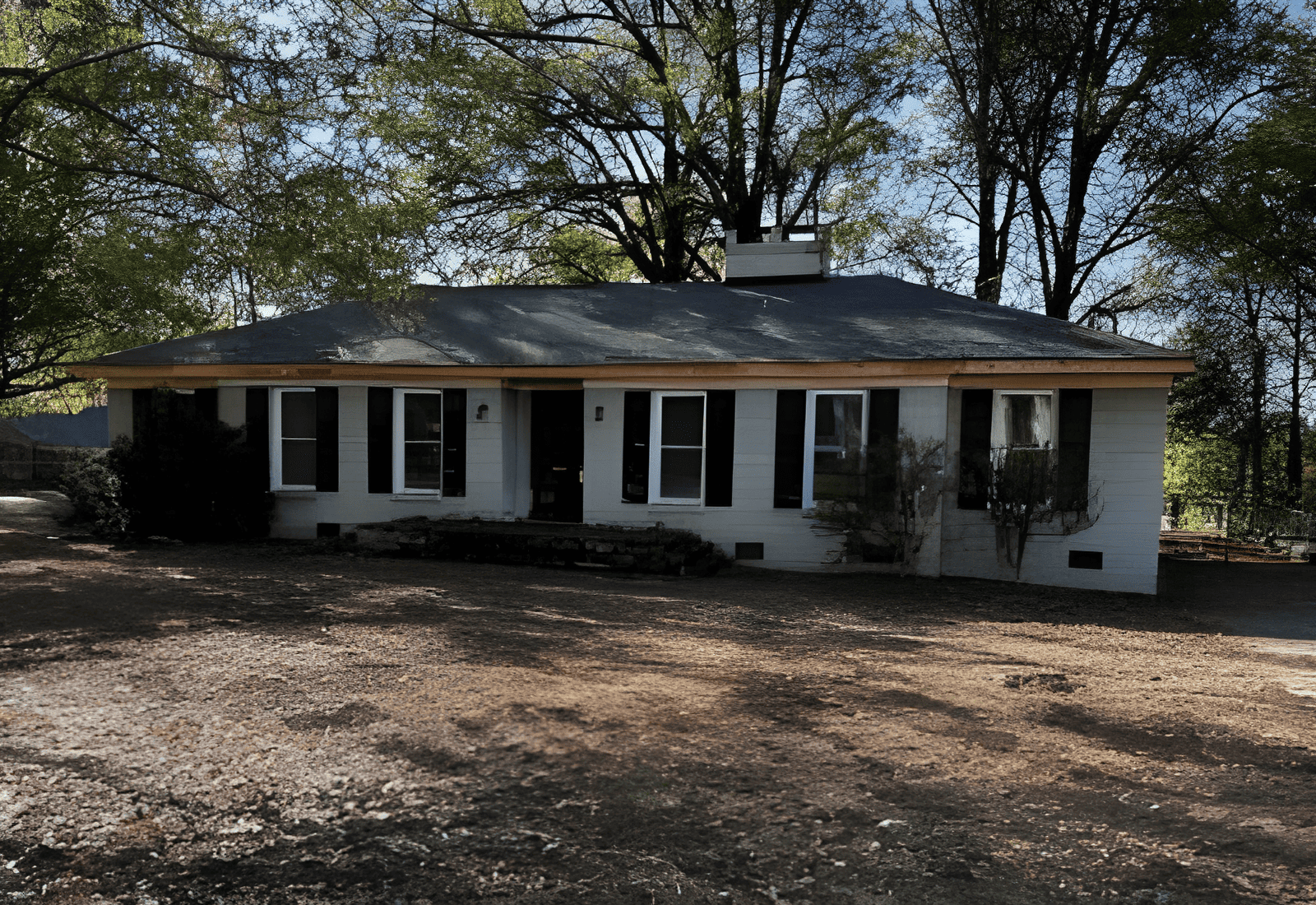

Fix & Flip Loan for Single-Family Residence in Charlotte, North Carolina

$455,000

RCN Capital, a national direct private lender, funded a $455,000 1st lien position fix and flip loan for a single-family home in Charlotte, North Carolina. We funded 76% of the $380,000 purchase price and 100% of the $113,000 renovation budget, while the Borrower contributed 24% cash to the purchase at closing. The after-repair value was estimated at $655,000, and the loan-to-after-repair value was 69.50%. The Borrower was a repeat and highly experienced investor (30+ Rental and 5+ Flipped). They plan to sell the property upon completion of the light rehab. The subject property is approximately 1,689 square feet. It was appraised for $450,000 As-Is and the $655,000 after-repair value evidenced a return on investment of 29.86%. The 4 Borrowers on the loan each have 25% ownership. Bank statements reflected substantial liquidity to close the loan. The interest rate was 10.74% and we charged a 1% origination point. The loan term was set at 12 months. This SFR fix and flip loan was funded in April 2023.

Fix & Flip Loan for Single-Family Residence in Charlotte, North Carolina

$512,500

RCN Capital, a national direct private lender, funded a $512,500 fix and flip loan in 1st and 2nd lien position for a single-family residence in Charlotte, NC. The purchase price was $405,000 and the renovation budget was $148,000. We funded 90% of the purchase and 100% of the renovation, while the Borrower contributed 10% cash at closing. The Borrower is a repeat and highly experienced investor (30+ Verified). High experience qualifies Borrowers for RCN’s platinum program to get 90% loan-to-purchase price. The subject property was appraised for $425,000 As-Is and an after-repair value of $735,000 evidenced a 30% return on investment. Four Sponsors on the loan each had 25% ownership and good expired credit reports on file. Bank statements reflected sufficient assets to close this deal. The loan was structured at 90/100/69.7. The 1,893-square-foot property was in condition and needed foundation repair. The Borrower plans to sell the property upon completion of the light rehab. The loan term was set at 12 months. The interest rate was 10.74% and we charged a 1% origination point. This SFR fix and flip loan was funded in January 2023.