Texas Fix and Flip Lenders

Are you flipping residential properties in Texas? On this page you'll find a list of fix and flip lenders throughout the state. Fix & flip lending is only for residenital properties with 1-4 units. We have a separate page for lenders that offer rehab/value-add financing for other property types. The maximum loan-to-after repair value for most lenders in Texas is 70%. You typically need some cash for the purchase (10%-20%) and some cash reserves.Searching...

Sorry, your search returned no results.

Malve Capital LLC

Fast And Easy Real Estate Loans. Closing as fast as 5 business days, subject to clear title.

RBI Private Lending

Direct lender, specialized in Bridge, Fix and Flip and Construction. FN and new investors welcome.

Funded Fix & Flip Loans in Texas

Easy Street Capital, a direct private real estate lender, funded a $226,950 1st lien position fix and flip loan for a single-family home in Fort Worth, Texas. We funded 85% of the $207,000 purchase price and $60,000 renovation budget, while the Borrower contributed 15% cash respectively at closing. The after-repair value was estimated at $325,000 so our loan-to-after-repair value was 70%. The Borrower, a local general contractor, is a novice investor with two completed flips and one rental in the local market. They had good cash reserves and credit. They plan to do a major rehab with some servicing of the utility systems and some demolition. They will be adding one bedroom and one full bath to make the home a 4-bed, 3-bath. The interior of the home will be getting new windows, trim, paint, drywall, flooring, appliances, and an updated kitchen/bathroom. The exterior of the home will be getting new framing, paint, pressure wash, and landscaping. The property is approximately 2,110 square feet set in an 8,886-square-foot lot. The interest rate was 9.9% and we charged 2% origination points. This SFR fix and flip loan was funded in November 2023.

Easy Street Capital, a direct private real estate lender, funded a $242,250 1st lien position fix and flip loan for a single-family home in Plano, Texas. We funded 85% of the $260,000 purchase price and 85% of the $25,000 renovation budget, while the Borrower contributed 15% cash respectively at closing. The after-repair value was estimated at $360,000 so our loan-to-after-repair value was 67%. The Borrower will be doing a cosmetic rehab of the subject with some servicing of the utility systems and foundation. The interior of the home will not be affected. The exterior of the home will be getting new roofing. The subject property is approximately 2,030 square feet set in a 7,840 square foot lot. It’s close to shopping malls and a school. The Borrower had good credit. They plan to sell the property as an exit strategy. The interest rate was 10.9% and we charged 2% origination points. The loan term was set at 6 months. This SFR fix and flip loan was funded in September 2023.

Easy Street Capital, a direct private real estate lender, funded a $269,500 1st lien position fix and flip loan for a single-family home in Garland, Dallas County, Texas. We funded 85% of the $255,000 purchase price and 85% of the $63,000 renovation budget, while the Borrower contributed 15% cash respectively at closing. The after-repair value was $385,000 so our loan-to-after-repair value was 70%. The Borrower will be doing a cosmetic rehab of the subject property with some servicing of the utility systems and demolition. The interior of the home will be getting new windows, doors, drywall, trim, paint, flooring, appliances, and an updated kitchen/bathroom. The exterior of the home will be getting new framing, siding, paint, pressure washing, landscaping, fencing, and final cleaning. The Borrower plans to sell the property upon completion of the light rehab. The subject property is approximately 1,764 square feet set in a 9,300-square-foot lot. The interest rate was 9.9% and we charged 2% origination points. The loan term was set at 6 months. This SFR fix and flip loan was funded in August 2023.

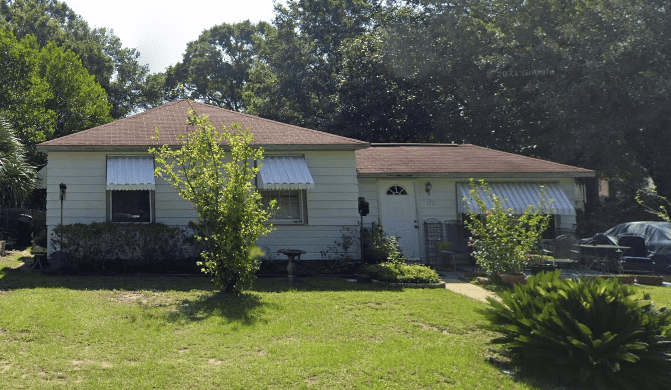

Easy Street Capital, a private real estate lender headquartered in Austin, funded a $174,250 1st lien position fix and flip loan for a single-family home in Desoto, TX. We funded 85% of both the $140,000 purchase price and the $65,000 renovation budget, while the Borrower contributed 15% cash at closing. The after-repair value was $250,000 so our loan-to-after-repair value was 70%. The Borrower was extremely tenured and had dozens of paid-off loans with Easy Street Capital. They are a full-time investor with great credit and cash reserves, a Preferred ESC Client in good standing with all teams. The subject property was approximately 1,367 square feet set in a 13,503-square-foot lot. The Borrower plans to sell the property upon completion of the light rehab. The interest rate was 9.9% and we charged 2% origination points. The loan term was set at 6 months. This SFR fix and flip loan was funded in May 2023.