Deal Details

Private Loan Type

Residential Fix and Flip

Approx. Funding Date

11/22/2022

Property Type

Property City

Halifax

Property State

MA

Loan Term (months)

12

Lien Type

1st Mortgage

Payment Type

Interest Only

Purchase Price

$160,000

Loan-to-Purchase Price

80%

Borrower's Contribution to Purchase

20%

Source of Borrower's Contribution

Cash

Renovation Budget

$140,000

Renovation Budget Funded

100%

Borrower's Contribution to Budget

0%

After-Repair Value

$410,000

Loan-to-After-Repair Value

65%

Property Neighborhood

Halifax

Location Type

Suburban

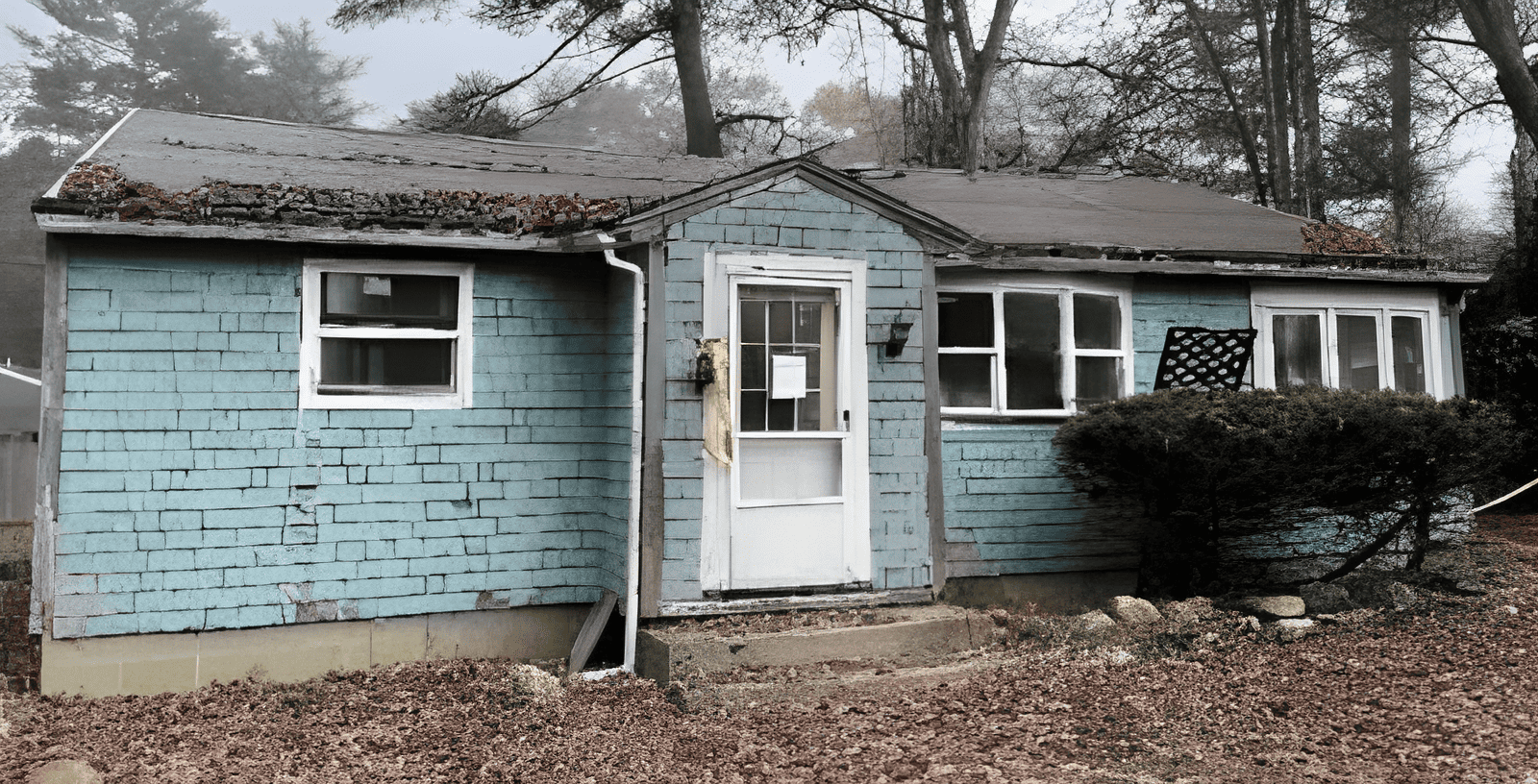

Property Condition

Fair

Borrower's Plan

Rehab and Sell

Exit Strategy

Sale

Borrower Credit Rating

Good

Interest Rate

9.99%

Origination Points

1.5%

Deal Summary

RCN Capital, a national direct private lender, funded a $268,520 fix and flip loan for a triplex in Halifax, MA. The Borrower is a repeat and experienced investor looking to take on another project under contract to acquire the subject property for $151,200 with intentions of spending $140,000 on renovations before listing the property for sale. We funded 100% of the renovation costs. The subject was appraised for $160,000 As-Is and an after-repair value (ARV) of $410,000 evidenced an ROI of over 38.64%. The Sponsor had decent credit with a mid score of 701 and bank statements that reflected sufficient assets to cover our liquidity requirement. The loan was structured and priced in accordance with the guidelines with an initial advance of 85.00% LTC & 80.30% LTV. They contributed 20% to the purchase at closing. The total loan amount was 65.50% of ARV. The subject property was in fair condition. The loan term was set at 12 months. The interest rate was 9.99%. We charged 2% origination points. This SFR fix and flip loan was funded in November 2022.

Dealmakers

Rich DeVito

Senior Loan Officer

Richard is always looking to help people fund their great real-estate investment ideas, from seasoned veterans in the space to first-time investors. Richard is known for his strong customer service and ability to develop long-term relationships with borrowers and brokers. He has a background in financial services/sales and has experienced great success by being knowledgeable, and professional, and understanding the investor’s experience is the number one priority. Richard attended Iona College and graduated from the Hagan School of Business with a degree in Finance.

)