SAN JOSE, CA – NOVEMBER 16, 2023 – Private Lender Link, a leading platform for connecting people with private lending companies, today announced a partnership with Analytics Logics, a private lending data provider, to enhance its mission of providing valuable private lending information to the public.

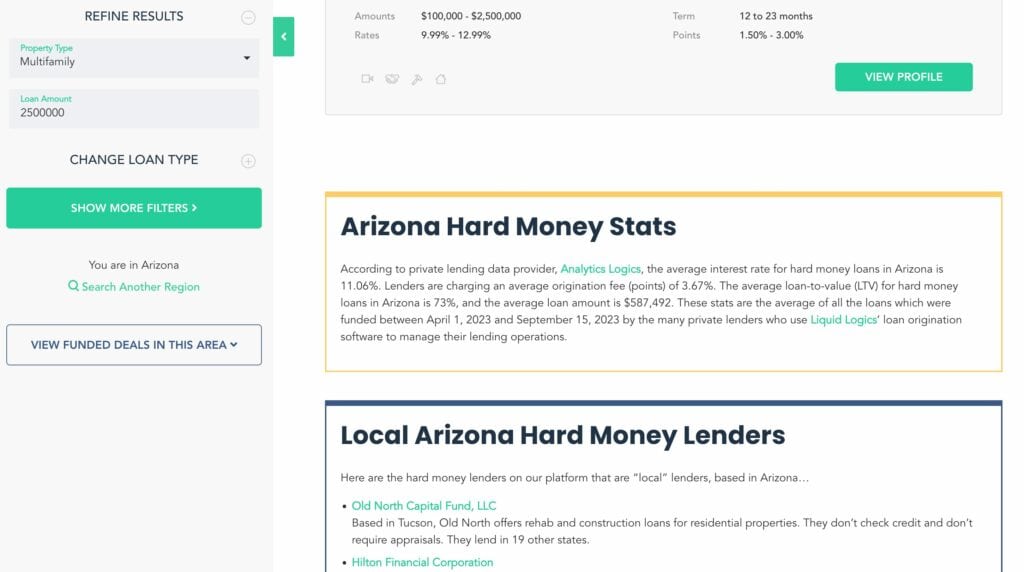

The new partnership means Private Lender Link will now provide its users with up-to-date statistics about private lending transactions for most states throughout the country, including the average loan amount, interest rate, points (origination fee), and loan-to-value. The data will be integrated into Private Lender Link’s platform and will be publicly available for all site visitors to access real-time data and customize their search based on specific criteria.

“We are thrilled to team up with Analytics Logics to provide valuable data to our users,” says Rocky Butani, CEO and Founder of Private Lender Link. “By leveraging their expertise in data analytics, we can provide our users with the most comprehensive and reliable information available in the market and brings us one step closer to our mission of being a powerful resource in private lending.”

“Partnering with Private Lender Link aligns perfectly with our mission to empower businesses with actionable insights derived from data,” says Alex Kaddah, Lead Data Analyst at Liquid Logics. “We are confident that our advanced analytics capabilities will add significant value to Private Lender Link’s platform and the real estate investors who rely on it.”

The benefits and features of this new partnership include:

- Key state specific metrics including average interest rates, average origination fees, average loan to value, and average loan amounts for the various loan types (fix & flip, fix to rent, ground-up construction, long-term rental).

- Enables private lenders to compare their offerings to those of the broader market, ensuring they remain competitive and attractive to borrowers.

- The data is open to the public on PrivateLenderLink.com and will be updated each quarter. Visitors can access this data by navigating to the Browse Lenders page and then selecting a loan type and state, where they will then be brought to the page highlighting the state-specific data provided by Analytics Logics.

The data blocks can be found on a few loan type/category pages:

- Hard Money (covers all loan types)

- Fix & Flip

- Rehab & Rent

- Residential Bridge

- Residential Construction

Please note that Analytics Logics doesn’t have data for every single loan type. In many states, you may only find data on Hard Money and Fix & Flip pages. A few states don’t have any data to report.

About Private Lender Link

Founded in 2010, Private Lender Link, Inc. (PLL) is an online platform where real estate investors and brokers connect with direct private lending companies for investment property deals throughout the United States. PLL has made great efforts to develop relationships with hundreds of non-bank lenders and strives to be a vital resource for everything related to private mortgage lending. Site visitors utilize the PPL platform to create loan requests and request lender recommendations. The information available on the PLL site is open to the public so anyone can compare information about each lending company and contact them directly.

About Analytics Logics

Analytics Logics was created in the summer of 2022 to provide businesses in the private lending space with the first-ever industry-wide reporting. The data provided by Analytics Logics comes from its parent company Liquid Logics, one of the largest software companies in the private money space. Analytics Logics specializes in data analytics and has developed an advanced algorithm that gathers and analyzes data from various sources to provide actionable insights.

Contacts:

Rocky Butani

Private Lender Link

408-413-2008

LinkedIn Profile

Alex Kaddah

Analytics Logics

816-652-0301

LinkedIn Profile

Stay Informed About Private Lending