Funded Deals Marketing

Private Lender Link offers a unique service to help private lending companies promote their closed loans to the public. We collect important details and write up a summary before posting each deal on our website and social media.

Leverage our audience and traffic to show off your deals

Promoting closed loans is the easiest marketing that any private lender can do, but may lenders don't have a structured system to execute this consistently. Private Lender Link has built an amazing system to help private lending companies present their funded deals and promote them to our audience consistently. This simple PR effort generates new leads and give lenders lots of great exposure to our audience of real estate investors and mortgage brokers.

How It Works

- Sign in to your Private Lender Link account

- Fill out a short form to provide details

- Upload at least one photo of the property

- Web page for your deal will be instantly published

- We’ll write a detailed summary

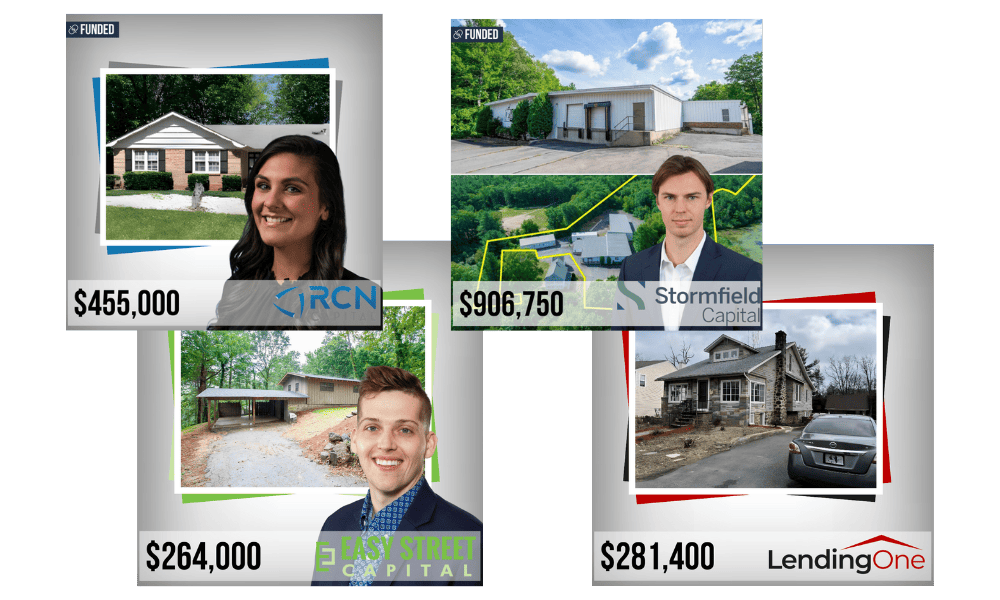

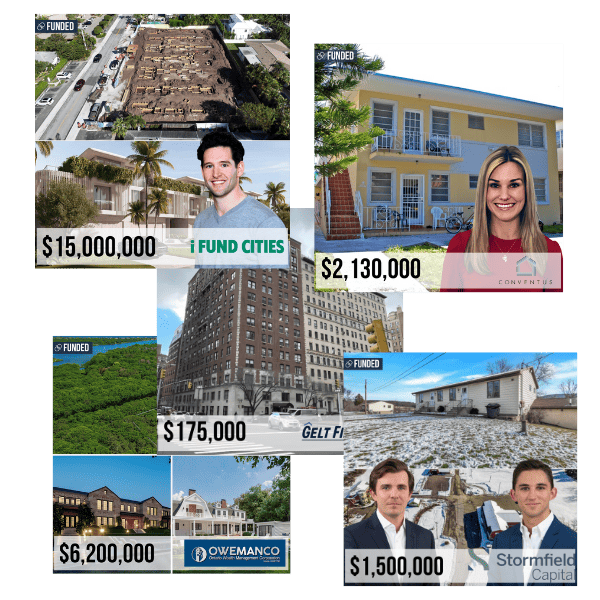

- We’ll create a custom image for social media

- We’ll post on LinkedIn, Instagram and Facebook*

- We’ll feature your deal in our monthly newsletter*

Watch the video above for a detailed explanation of our Funded Deals marketing service for private lending companies (aka hard money lenders).

More Than a Tombstone

We go above and beyond to give your deals an impressive presentation with a detailed summary that explains how the deal was structured in terms of leverage and lots of other key highlights. Simply fill out some data fields, and we’ll write up the summary. The premise behind our Funded Deals platform is to provide enough important information about your closed loans so that potential borrowers & brokers can learn about your guidelines and determine if you may be the right lender for their next deal.

Additional Exposure on Our Platform

All of your deals will be searchable on the main Funded page of our site. Borrowers and brokers use this to find lenders that have funded deals similar to their needs. They can filter by property type, loan type, location and much more. So long as we have enough information to write a summary with 150+ words, we’ll feature your deal on the relevant search page of our site. For example, if you deal is a bridge loan for a retail property in Atlanta, we’ll feature it on the Georgia CRE Bridge Lenders search page, under the list of lenders.

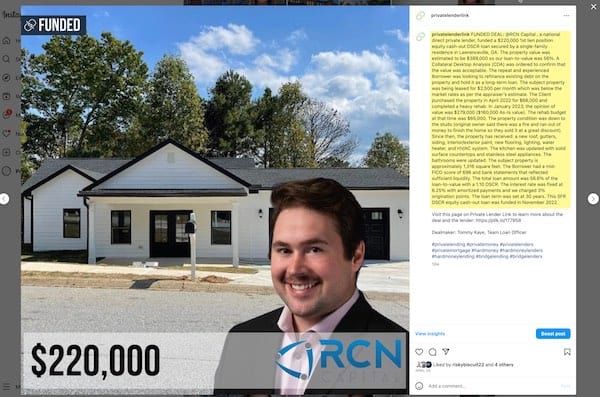

Promoted on Social Media

When we promote deals on social media, we include the detailed summary which we generate using the data points you provide. This enhances the posts by providing viewers important details about the deal so they can learn about the deal structure and some of the deal highlights. We’ll tag your company to give you more exposure on each social channel. If you include a dealmaker (loan officer) in your post, we’ll tag that individual on LinkedIn, and you can have multiple dealmakers.

Featured in Our Newsletters

We send out an email every month to our audience of over 10,000 subscribers which features one deal from each lender that has posted a deal in the month prior. Click here to see an example of our Funded newsletter.

Pricing

We offer a monthly subscription plan to help you promote deals consistently on a monthly basis, without any long-term obligation. You can cancel at any time. Click the boxes below to see the pricing for each package.

Lenders paying a monthly subscription of less than $500:

$100 per deal

We’ll send an invoice after your deal has been published.

Lenders paying a monthly subscription of $500 – $950:

1 Deal per month included ($0)

$100 per each additional deal in a calendar month.

Lenders paying a monthly subscription of $950 – $2,000+

2 Deals per month included ($0)

$100 per each additional deal in a calendar month.

Lender that are not currently paying a monthly fee to be listed on PrivateLenderLink.com.

$150 per deal

We’ll send an invoice after your deal has been published and approved.

Deal Posting Rules

We have a few rules for posting deals:

- No contact information or links to your website – viewers can click a button to view your profile and contact info

- Photo Required – deal will not show up if you don’t add a photo, and you must use a real photo of the subject property. No city skylines or fake property photos. Aerial images are acceptable. Renderings and blueprint images are acceptable for construction loans.

- No text or logos embedded in the photo – keep it plain and simple

- No marketing statements – don’t include a tagline or the same wording on all of your posts; just focus on the transaction

- No sensitive information – we feel it’s unnecessary to include the subject property address or borrower’s name, but if you decide to include it, make sure you have the borrower’s permission

We will remove Funded Deal posts that do not follow these rules.

*In order for your deal to be featured in newsletters and social media, we must have enough information to write a summary with 140+ words.

Why private lenders should promote their funded deals

- Generates leads

When real estate investors and brokers see your funded deal posts, they may reach out to you with their loan requests for similar deals. Posting your deals in an easy way to remind people that you’re actively lending and funding deals. Even for people that already know your company and/or have a relationship with you, it’s beneficial to stay top of mind with that audience. - Gives your company credibility

Promoting your funded deals shows that your company is actively closing deals and that you are a credible lender. Especially when you use our platform, our detailed summaries will impress viewers by informing them of the deal structure, pricing and the reasons why the borrower chose to do business with you. - Grows your social media following

When we promote your deals on our social media, we tag your company so that real estate investors, broker and lenders can view your social profile and follow your company. This is an easy way to grow your own social media network.