Deal Details

Private Loan Type

Residential Fix and Flip

Approx. Funding Date

02/09/2023

Property Type

Property City

Pearl River

Property State

NY

Loan Term (months)

12

Lien Type

1st Mortgage

Payment Type

Interest Only

Purchase Price

$410,000

Loan-to-Purchase Price

75%

Borrower's Contribution to Purchase

15%

Source of Borrower's Contribution

Cash

Renovation Budget

$45,355

Renovation Budget Funded

100%

Borrower's Contribution to Budget

0%

After-Repair Value

$550,000

Loan-to-After-Repair Value

62.80%

Renovation Project Scope

Light Rehab

Location Type

Urban

Property Condition

Good

Number of Units

2

Building Square Footage

1,312

Lot Square Footage

8,712

Borrower's Plan

Rehab and Rent

Exit Strategy

Refinance

Interest Rate

12.74%

Origination Points

3%

Deal Summary

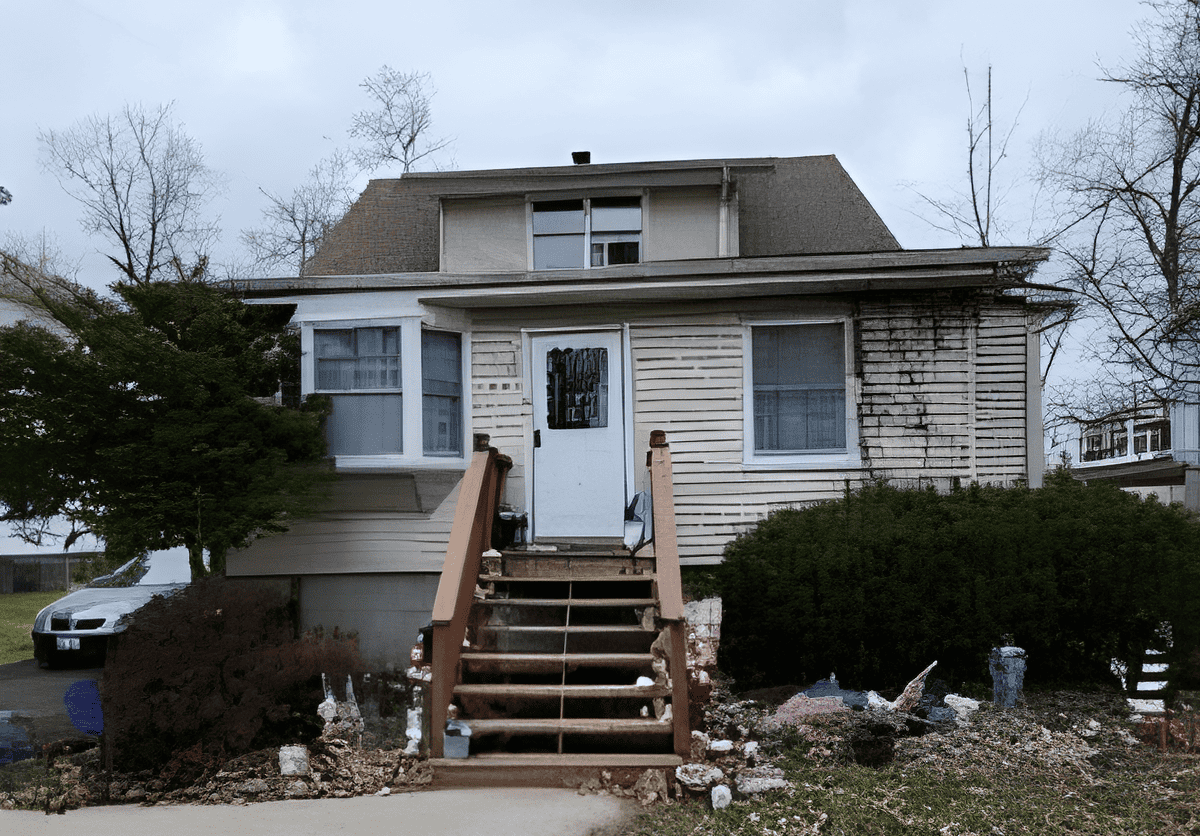

RCN Capital, a national direct private lender, funded a $345,355 1st lien position hard money loan for a 2-unit residential property in Pearl River, Rockland County, NY. We funded 75% of the $410,000 purchase price and 100% of the $45,355 renovation budget, while the Borrower contributed 25% cash to the purchase at closing. The subject property was appraised for $400,000 As-Is and an after-repair value of $550,000 evidenced a good ROI for the Borrower of over 17.61%. Initial advance was 73.20% LTC & 75.00% LTV. The total loan amount was 62.80% of the after-repair value (ARV). The subject property was approximately 1,312 square feet set in an 8,712-square-foot lot. The Sponsor had a mid score of 718 and bank statements that reflected sufficient assets. The Borrower plans to lease the property upon completion of the light rehab and eventually refinance as an exit strategy. The interest rate was 12.74%. We charged 3% origination points. The loan term was set at 12 months. This residential hard money loan was funded in February 2023.

Dealmakers

Scott Evans

Regional Loan Operations

Scott joined RCN Capital in October 2022. Working from his satellite office in the Orlando market, he brings 4 years of private lending experience to help build and expand RCN’s preverbal footprint to the bourgeoning investor real estate industry in the Sunshine state. Scott has had the good fortune to attend over 100 conferences where he established a solid reputation and developed substantial relationships throughout the industry nationwide. He looks to strengthen and expand RCN’s involvement in those trade associations in the Southeast Region in the near future.

)