Deal Details

Private Loan Type

Equity Cash Out

Approx. Funding Date

09/13/2023

Property Type

Property City

Broken Bow

Property State

OK

Loan Term (months)

12

Lien Type

1st Mortgage

Payment Type

Interest Only

Property Value

$182,500

Renovation Budget

$120,500

Renovation Budget Funded

100%

Borrower's Contribution to Budget

0%

After-Repair Value

$493,000

Loan-to-After-Repair Value

60%

Renovation Project Scope

Heavy Rehab

Location Type

Suburban

Property Condition

Poor

Occupancy at Closing

Vacant

Building Square Footage

1,176

Borrower's Plan

Rehab and Rent

Exit Strategy

Refinance

Borrower Credit Rating

Excellent

Interest Rate

11.49%

Origination Points

3.25%

Deal Summary

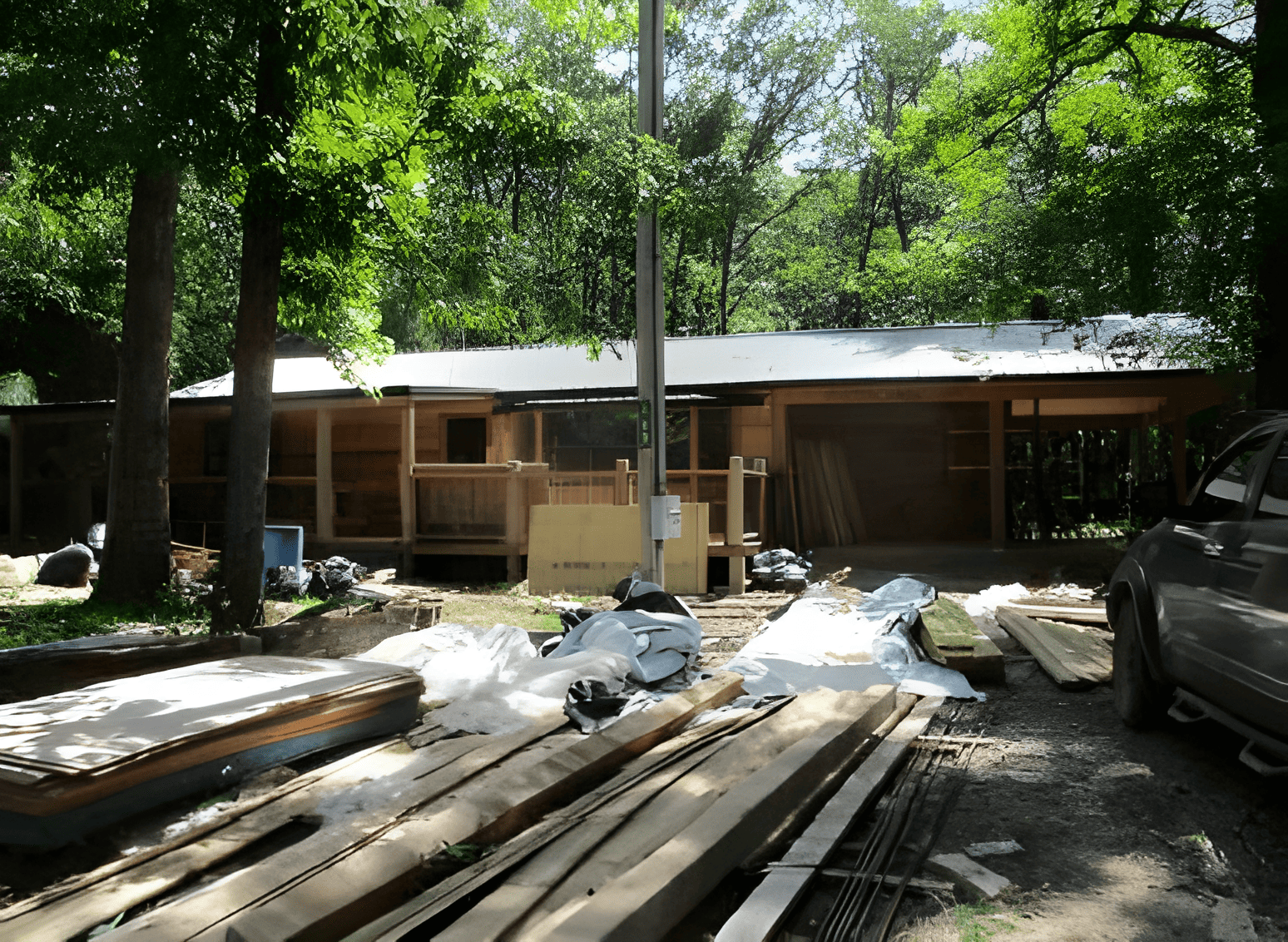

RCN Capital, a national direct private lender, funded a $230,000 1st lien position equity cash-out refinance loan secured by a single-family home in Broken Bow, Oklahoma. The property was initially purchased for $118,000 in October 2020. The Borrower needed to complete a major renovation of the property before placing tenants in it. The as-is value was estimated at $182,500. We provided $120,500 as a controlled rehab budget to be released in multiple draws. The after-repair value was estimated at $493,000 which put our loan at a 60% loan-to-value. And the Borrower will see a solid return of 104%. They had a lot of experience and excellent credit, with a middle score of 712 and their bank statements showed sufficient liquidity to meet the reserves required for this loan. They plan to lease the property upon completion of the heavy rehab and eventually refinance it as an exit strategy. It is approximately 1,176 square feet. The interest rate was 11.49% and we charged 3.25% origination points. The loan term was set at 12 months. This rehab-to-rent loan was funded in September 2023.

Dealmakers

Connor Hibbs

Loan Officer

Connor joined RCN Capital in the Fall of 2019. He brings adept critical thinking skills, superior communication skills, and a desire to build and maintain strong customer relationships. Connor’s mission is to amplify RCN’s presence in local and national markets. He has had previous work experience in sales with AIL along with several years of customer service. Connor Hibbs graduated from the University of Connecticut with a degree in Economics and a Minor in Anthropology while also participating in the University’s Club Hockey and Club Lacrosse programs.

)