Deal Details

Private Loan Type

Purchase

Approx. Funding Date

12/12/2023

Property Type

Property City

Cincinnati

Property State

OH

Loan Term (months)

360

Payment Type

Amortized

Purchase Price

$120,970

Loan-to-Purchase Price

77%

Borrower's Contribution to Purchase

23%

Term

30 years

Rate Type

Fixed

Debt Service Coverage Ratio

1.59

Location Type

Suburban

Property Condition

Excellent

Occupancy at Closing

Tenant-Occupied

Number of Units

2

Building Square Footage

1,720

Borrower's Plan

Long-Term Rental

Borrower Credit Rating

Good

Interest Rate

9.09%

Origination Points

0%

Deal Summary

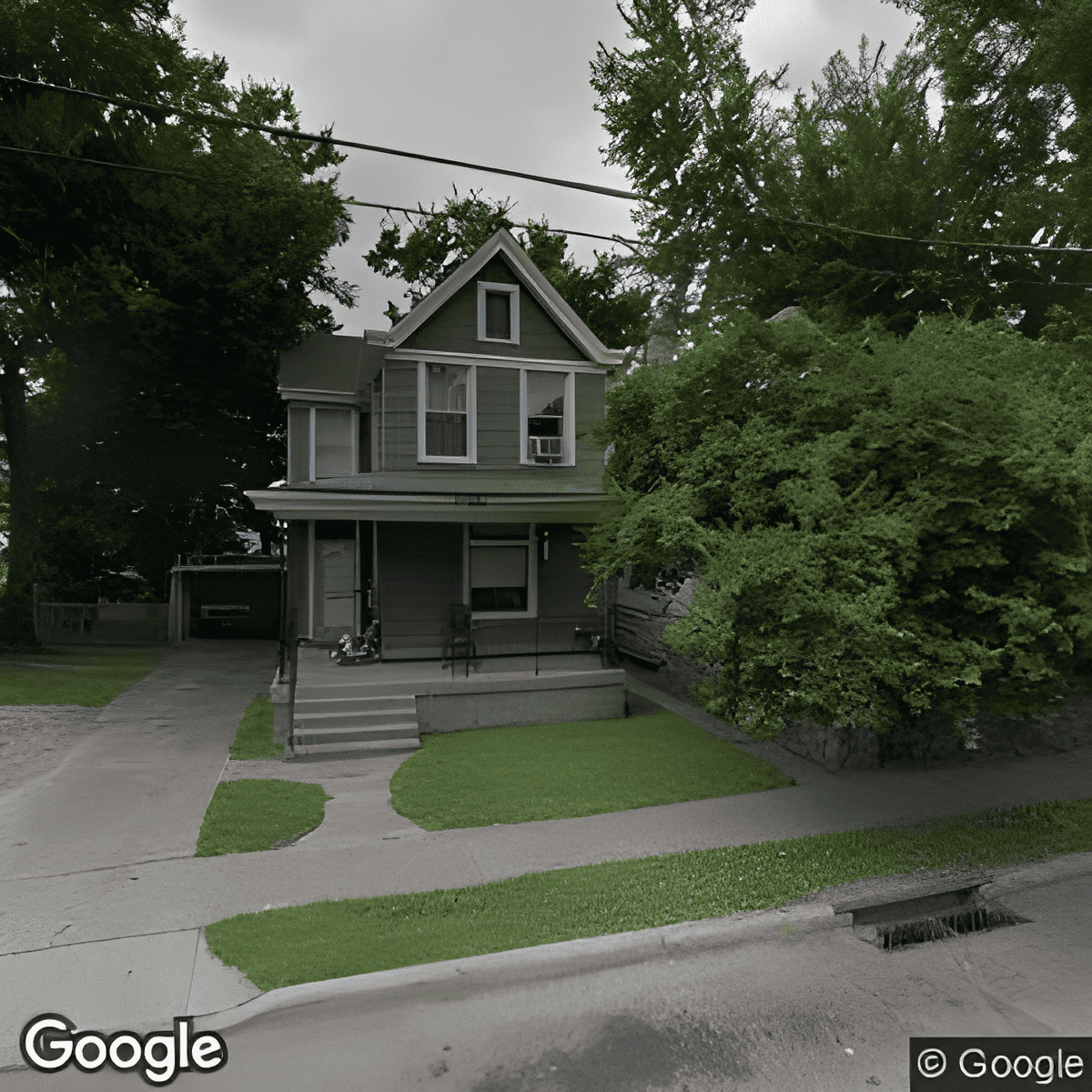

RCN Capital, a national direct private lender, funded a $96,776 1st lien position DSCR long-term rental loan for the acquisition of a 2-unit residential property in Cincinnati, OH. We funded 80% of the $120,970 purchase price, while the Borrower contributed 20% cash at closing. The subject property was in excellent condition and tenant-occupied at closing. The subject property was approximately 1,720 square feet and was appraised for $125,000 As-Is. The Sponsor had good credit and bank statements that reflected sufficient balance to cover the liquidity. The rental income resulted in a debt service coverage ratio of 1.59. The interest rate was fixed at 9% with amortized payment. The loan term was set at 30 years. This DSCR rental purchase loan was funded in December 2023.

Dealmakers

Chris Conklin

Team Loan Officer

Chris began his relationship with RCN Capital as a Lead Development Specialist in Fall of 2021. He quickly made an impact, hitting the top LDS goal six months in a row at one point, while developing an understanding of the products and policies here at RCN Capital. He takes pride in providing the best customer service he can to his customers, brokers, and clients. Prior to joining RCN Capital, Chris graduated from Northeastern University with a Bachelor’s degree in Economics, while minoring in Chinese. He got a job at W.B. Mason after college, rising up to Corporate Purchasing Manager over the next 5 years.

)