Los Angeles Bridge Lenders for Residential Investment Property

Are you seeking a bridge loan secured by residential property in the Los Angeles metro area? On this page you'll find a list of select bridge lenders for Los Angeles investment properties with 1 to 4 units. To get a 1st lien bridge loan, you must have at least 30% equity. Due to state laws and regulations, it's not possible to get a bridge loan for a homestead (owner-occupied primary residence) or 2nd home, but if that's what you're seeking, use the filters to change the loan type to 'Residential Owner-Occupied' and you may find some alternative lending options.Searching...

Sorry, your search returned no results.

SDC Capital

Family Office Lender. No 3rd-party appraisal (typically). Soft Money Terms in 1st or 2nd Lien Position.

PrideCo Loans Inc.

Family Office Hard Money Lender for Multifamily and Residential Investment Properties

Los Angeles Bridge Loan Interest Rates

According to the loan documents software company, Lightning Docs, the average interest rate for Los Angeles bridge loans in the 4th quarter of 2023 was 11.44%. The average loan amount was $532,161. These stats are the average of 547 short-term loans (including rehab and ground-up construction loans) funded for investment properties in the Los Angeles metro area between October 1, 2023 and December 31, 2023 by multiple bridge lenders that use Lightning Docs as their preferred software provider to prepare loan documents. Of the 547 total loans in the 3-month period, 377 were secured by properties in L.A. County, 74 in Orange County, 44 in Riverside County, 41 in San Bernardino County, and 11 in Ventura County.

Funded Residential Bridge Loans in Los Angeles

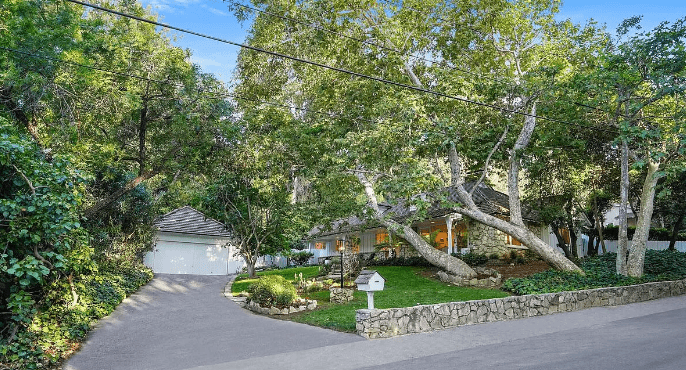

Cityscape Finance, a direct private lending firm, funded a $2,200,000 bridge loan for the purchase of a single-family residence in Studio City, Los Angeles County, California. The purchase price was $3,500,000. We funded 62.85% of the purchase price, and the Borrower contributed 37.15% cash at closing. The Borrower had a good credit rating and lots of cash. They plan to stabilize the property with a tenant and then refinance into a 30-year rental loan within the 18-month loan term. The house was in good condition and is 2,816 square feet. This residential property bridge loan was funded in July 2022.

Purchase & Rehab Bridge Loan for Luxury SFR in Los Angeles, CA

$3,740,000

The Opportunity

A commercial broker and partner of Lima One, had a client that was looking to purchase and rehab a 3,800-square-foot home in West Hollywood – an upscale and trendy neighborhood of Los Angeles, California. The home, built in 1937, was in a condition to resell as is, but the borrower opted to remodel the property with a mid-century modern design to capitalize on the opportunity to resell it as a luxury fix and flip property in a market experiencing all-time-high home prices.

The Solution

Even though the purchase price of the home was above the current appraisal, Lima One was able to underwrite the property based on the after-repair value of $5.9 million. This gave the investor nearly half a million dollars in profit after the $4.8 million purchase and $400,000 renovation. The 19-month, interest-only loan minimized overall financing costs, on top of the added benefit of the investor not having to pay interest on undrawn construction funds. The result was an opportunity for the investor to create equity on a luxury property for a maximum profit and the ability to scale his fix and flip business.

This purchase and rehab SFR bridge loan was funded in May 2022.