Virginia Fix and Flip Lenders

Are you flipping residential properties in Virginia? On this page you'll find a list of fix and flip lenders throughout Virginia. Fix & flip lending is only for residential properties with 1-4 units. We have a separate page for lenders that offer rehab/value-add financing for other property types. The maximum loan-to-after repair value (LTARV) for most lenders in Virginia is 70%. You typically need some cash for the purchase (15%-20%) and some cash reserves.Searching...

Sorry, your search returned no results.

Real Property Investment Partners

NO APPRAISAL REQUIRED. Providing institutional-grade lending with a local presence.

Funded Fix & Flip Deals in Virginia

Rehab Financial Group, a private money lender, funded a $575,000 1st lien position fix and flip loan for a single-family home in Norfolk, VA. We funded 100% of the $350,000 purchase price and 100% of the $225,000 renovation budget. The after-repair value was estimated at $829,000 so our loan-to-value was 69.36%. The Borrower put no money down. They had to self-fund the first phase of the rehab budget but we will reimburse them once that phase is completed. The subject property was vacant at closing. It was approximately 4,283 square feet. The Borrower had excellent credit, which is one of the requirements for our 100% financing program. They plan to sell the property upon completion of the heavy rehab. The interest rate was 11.99% and we charged 2.75% origination points. The loan term was set at 12 months. This SFR fix and flip loan was funded in May 2023.

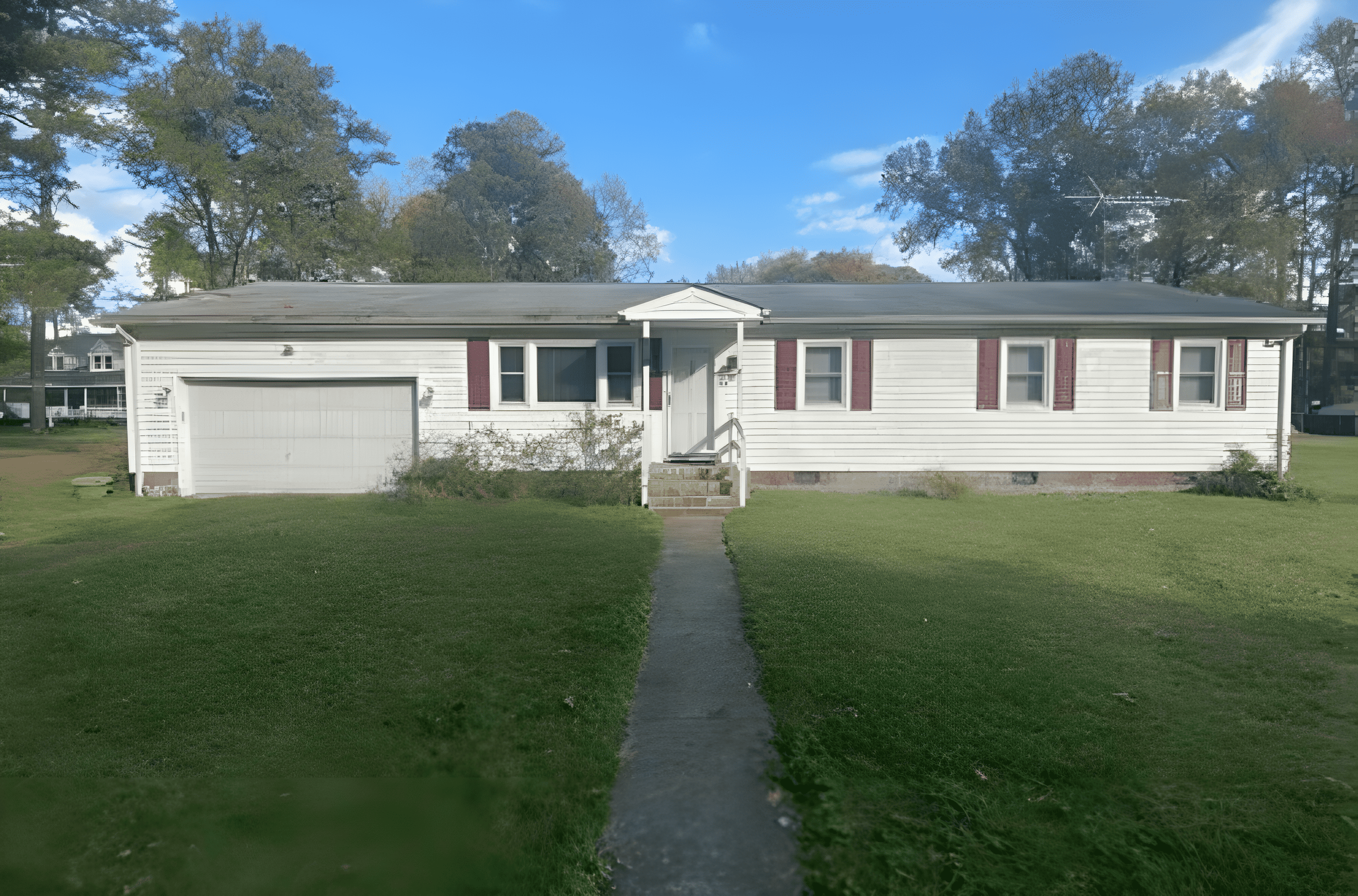

Navigator Private Capital, a nationwide private real estate lender, funded a $290,000 fix and flip loan for a single-family residence in suburban Chesapeake, VA. The purchase price was $275,000 and the renovation budget was $87,000. We funded 80% of the purchase and renovation in 1st lien position. The Borrower contributed 20% of the project costs in cash. The estimated after-repair-value was $405,000 so the loan-to-ARV that we funded was 72%. This single family flip is located on two lots over four acres. The existing house is 1,400 square feet on a 4-acre lot with four bedrooms and two baths. Our clients recognized the potential to turn this house into a family home by opening up the floor plan and adding 800 square feet of living space to the back of the structure. With plans for an expanded and updated master bedroom suite, new roof and windows, and a sparkling new kitchen, this property is destined for greatness. The subject property was in good condition and vacant at closing. The Borrower had excellent credit. They plan to sell the home upon completion of the light rehab. The loan term was set at 9 months. This SFR fix and flip loan was funded in November 2022.

The Opportunity

An experienced flipper had the opportunity to purchase a condo in the Washington, D.C., suburb of Alexandria, Virginia—but needed to move quickly. The 941-square foot condo, built in 1941, needed capital expenditures for a new roof and updated electrical, as well as cosmetic updates to bring it back up to market expectations. Due to the demand in one of D.C.s most desired suburbs, the rehabbed condo could turn a considerable profit.

The borrower was already approved for credit exposure with Lima One, and was in process on several other deals at the time. So he came to his sales rep with the request for an expedited close to purchase the property in a fast-moving real estate market so he could capitalize on this opportunity.

The Solution

Lima One was able to close this FixNFlip loan in just six calendar days after application. With a 92% blended loan to cost, the borrower was able to cover the entire rehab budget and 90% of the purchase price, limiting the down payment.

Due to the age and condition of the property, Lima One’s pre-close construction budget review revealed the need for the borrower to add more extensive roof and electrical upgrades to mitigate risk and maximize profits on the investment. The rehab budget increased along with the available drawable funds; however, the borrower was not responsible for interest on undrawn construction funds, allowing him to manage cash flow throughout the rehab. With Lima One’s construction draw process, the borrower could access money when needed throughout the project.

Lima One’s FixNFlip financing makes this deal a home run for the investor—with the ability to make a 20% profit of $60,000-plus when selling the flip.

The subject property was in fair condition at closing. The Borrower plans to lease the property at the market and eventually refinance as an exit strategy. The loan term was set at 13 months. This fix and flip bridge loan was funded in June 2022.