New York Hard Money Lenders

Need a hard money loan secured by real estate in New York? This page has a list of direct hard money lenders that offer quick funding for a NY property purchase, refinance, fix & flip, rehab & rent, ground-up construction, and equity cash out in 1st lien position. Hard Money lending is mainly based on equity in the subject property. The maximum LTV is typically 70% for most lenders. Scroll to see the list of lenders and continue scrolling ot see summaries of hard money loans funded by lenders in our network.New York is a large state, and many hard money lenders focus on particular metropolitan areas. Filter your search by selecting a region:

Searching...

Sorry, your search returned no results.

Malve Capital LLC

Fast And Easy Real Estate Loans. Closing as fast as 5 business days, subject to clear title.

New York Hard Money Interest Rates

According to the hard money loan documents software company, Lightning Docs, the average interest rate for New York hard money loans in the 1st quarter of 2024 was 12.00%. The average loan amount was $732,611. These stats are the average of 94 short-term loans (including bridge, rehab, and ground-up construction) funded for properties in New York between January 1, 2024 and March 31, 2024 by multiple hard money lenders that use Lightning Docs as their preferred software provider to prepare loan documents.

According to private lending data provider, Analytics Logics, the average interest rate for New York hard money loans in the 1st quarter of 2024 was 11.53%. Lenders charged an average of 2.4% points (origination fee). The average LTV (loan-to-value) for hard money loans in New York was 62%, and the average loan amount was $1,190,000. These stats are the average of all the loans which were funded between January 1, 2024 and March 31, 2024 by the many hard money lenders who use Liquid Logics’ loan origination software to manage their lending operations.

Top 10 New York Hard Money Lenders

According to Forecasa™, here are the Top 10 Hard Money Lenders ranked by the number of loans originated in New York in the last 12 months from March 2024.

- ROC Capital

- Broadview Funding

- Adirondack Trust CO

- Icecap Group

- RCN Capital LLC

- Constructive Loans LLC

- Velocity Commercial Capital

- Kiavi

- Bayport Funding LLC

- Insula Capital Group LLC

Forecasa™ provides analytics data for New York hard money lending on a quarterly basis. You’ll find their top lenders data for many other states on our platform.

Funded Hard Money Loans in New York

Hard Money Refinance Loan for Mixed-Use Property in Brooklyn, New York

$450,000

Gelt Financial, a direct CRE private lender, funded a $450,000 1st lien position hard money refinance loan secured by a 3-unit mixed-use property in Brooklyn, New York. The property value was estimated at $900,000 so our loan-to-value was 50%. Located in the Flatbush neighborhood of Brooklyn, the property contained 2 residential units and 1 commercial unit. The owner recently renovated one of the residential units. They approached Gelt Financial because their previous mortgage was ballooning and the lender wasn’t interested in refinancing. The subject property was partially occupied at closing and contained one 3-bed unit, one 2-bed unit, and 1 commercial unit. It was owner-managed with annual leases in place with long-term tenants. The subject property was built in 1925 and was in good condition. It was approximately 5,000 square feet. The Borrower had good credit. They plan to lease up the vacant units and eventually refinance as an exit strategy. The interest rate was 13% floating, and we charged 3% origination points. The loan term was set at 12 months. This hard money loan was funded in March 2023.

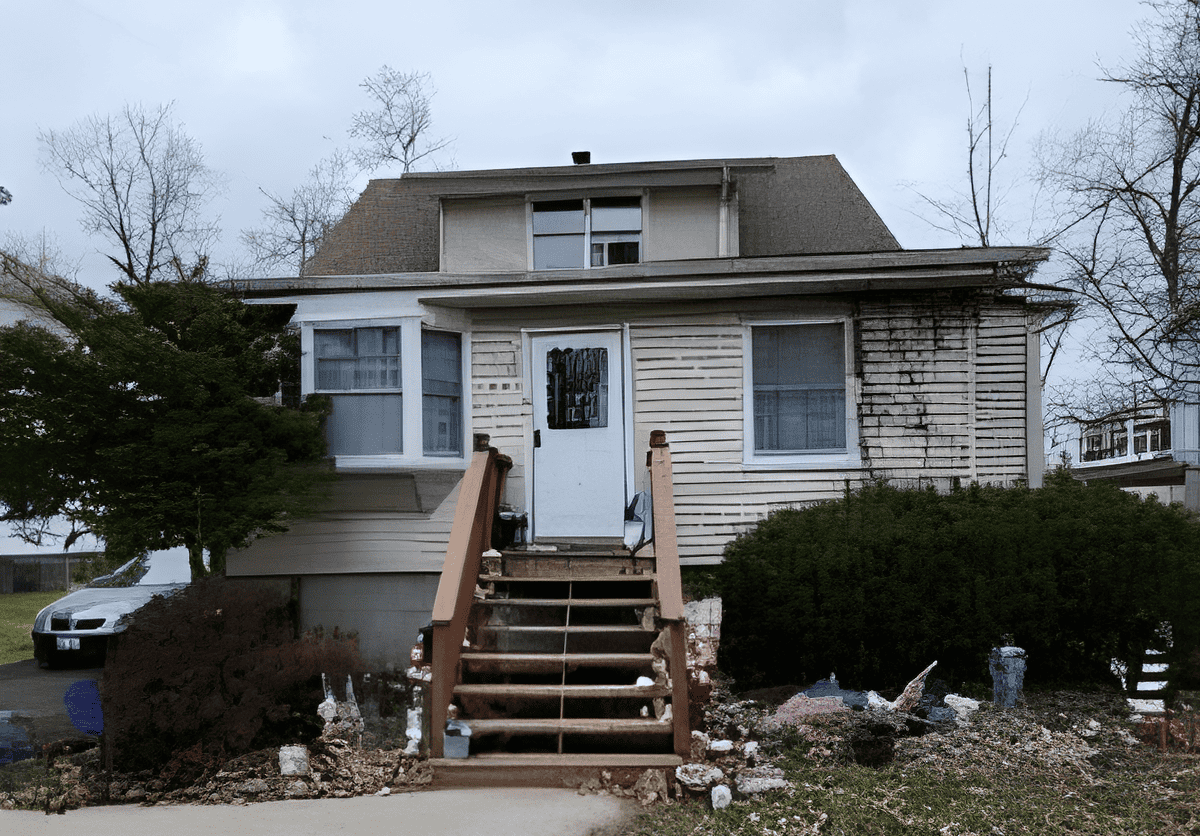

Residential Hard Money Loan for 2-Unit Rental Property in Pearl River, New York

$345,355

RCN Capital, a national direct private lender, funded a $345,355 1st lien position hard money loan for a 2-unit residential property in Pearl River, Rockland County, NY. We funded 75% of the $410,000 purchase price and 100% of the $45,355 renovation budget, while the Borrower contributed 25% cash to the purchase at closing. The subject property was appraised for $400,000 As-Is and an after-repair value of $550,000 evidenced a good ROI for the Borrower of over 17.61%. Initial advance was 73.20% LTC & 75.00% LTV. The total loan amount was 62.80% of the after-repair value (ARV). The subject property was approximately 1,312 square feet set in an 8,712-square-foot lot. The Sponsor had a mid score of 718 and bank statements that reflected sufficient assets. The Borrower plans to lease the property upon completion of the light rehab and eventually refinance as an exit strategy. The interest rate was 12.74%. We charged 3% origination points. The loan term was set at 12 months. This residential hard money loan was funded in February 2023.